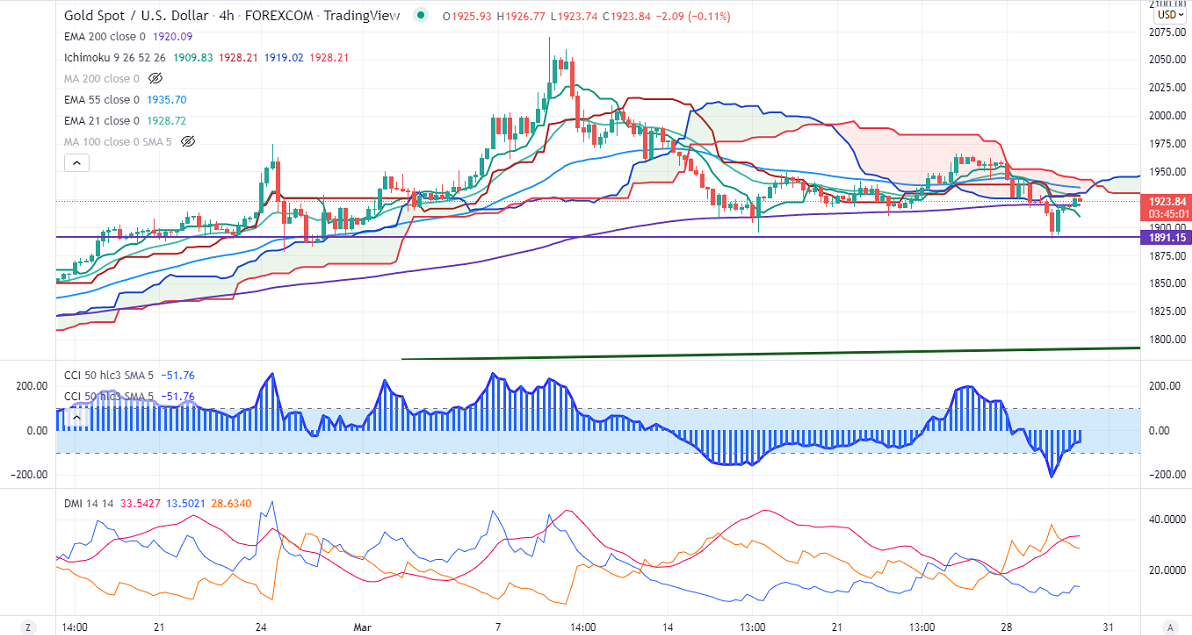

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- $1915.20

Kijun-Sen- $1928.21

Gold regained slightly from a low of $1890 on the weak US dollar. The US dollar index lost its shine after Russia said that it will cut back military operations near Kyiv during peace talks. The minor profit booking US treasury yield also supports yellow metal at lower levels. It hits an intraday high of $1927.39 and is currently trading around $1926.30.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1918, violation below targets $1910/$1895/$1877/$1850/$1800. Significant reversal only below $1750.The yellow metal faces strong resistance of $1940, any breach above will take to the next level $1977/$2000/$2020.

It is good to sell on rallies around $1928-30 with SL around $1950 for TP of $1850.