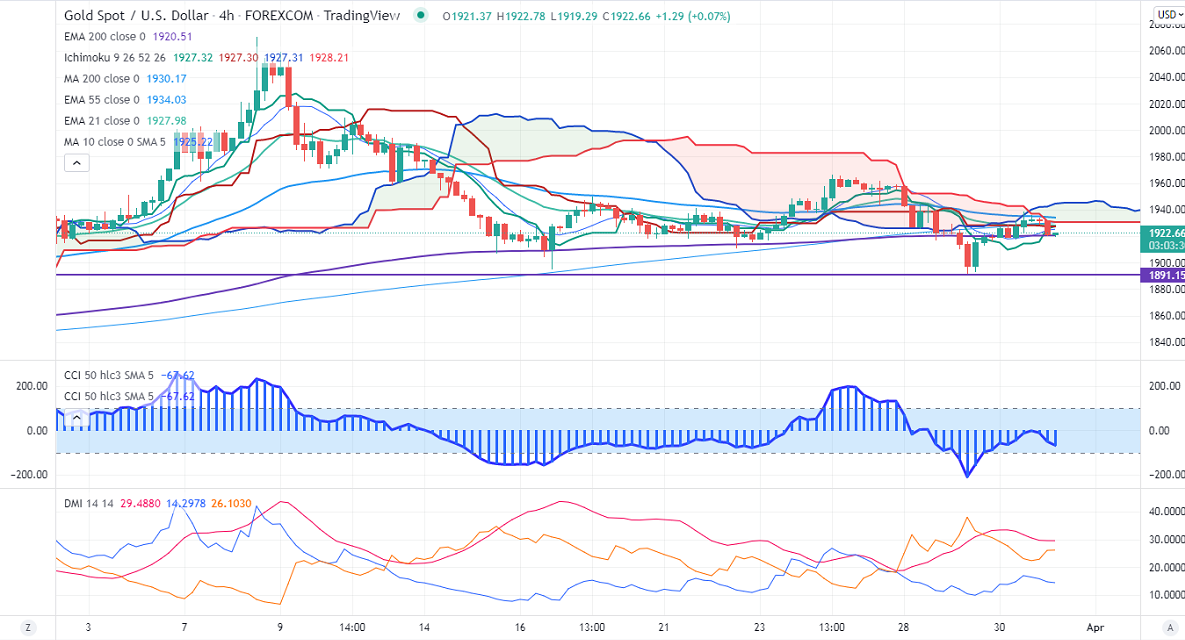

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- $1925.77

Kijun-Sen- $1927.30

Gold continues to trade lower after showing a minor pullback. The hope of diplomacy between the Russia and Ukraine crisis has decreased demand for safe-haven assets like gold. The sell-off in the US dollar index and US treasury yields prevents further downside risks in the yellow metal. It hits an intraday high of $1920 and is currently trading around $1922.

The private payroll has added 455000 jobs in Mar compared to a forecast of 450000. US GDP rose to a 6.9% annualized rate vs an estimate of 7%.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1918, violation below targets $1910/$1895/$1877/$1850/$1800. Significant reversal only below $1750.The yellow metal faces strong resistance of $1940, any breach above will take to the next level $1977/$2000/$2020.

It is good to sell on rallies around $1928-30 with SL around $1950 for TP of $1850.