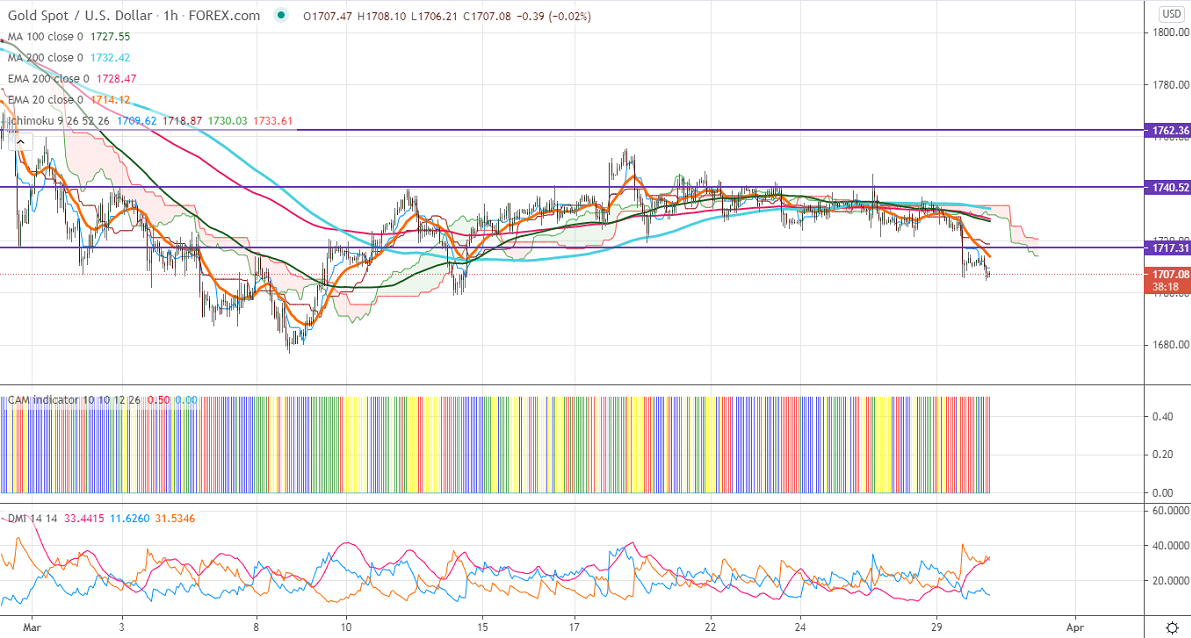

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1709.62

Kijun-Sen- $1718

Gold breaks significant support at $1719 and declined more than $10 on broad-based US dollar buying. DXY is holding well above 200- day EMA, any jump above 93 targets 93.60/94. The jump in US 10-year bond yield on US vaccine optimism is also putting pressure on the yellow metal. The 10-year yield surged more than 7% from minor bottom 1.63%.

Economic data:

With no major economic data today, markets eye US nonfarm payroll data on Friday for further direction. The Conference Board Consumer confidence data which is to be released today will have a minor impact.

Technical:

It is facing strong support at $1700, violation below targets $1675/$1650/$1625. On the higher side, near-term resistance is around $1725, any indicative break above that level will take till $1745/$1760/$1783.

It is good to sell on rallies around $1710-11 with SL around $1725 for the TP of $1675/$1650.