Gold continues to trade higher for the past 4 weeks and hits 6- year high on account of US-China trade war escalation and declining bond yield. China has imposed tariffs of 5-10% on US goods worth $75 billion.US President Trump has said that it would raise tariffs from 25% to 30% on $250 billion goods and to 15% on another $300 billion tariffs. The yellow metal hits high of $1555 and shown a minor decline due to profit booking. It is currently trading around $1528.36.

US 10 year bond yield continues to trade lower and lost more than 12% in the past two trading days after dovish comment from Fed Chairman. It is currently trading at 1.458%. The yield curve between US 10 year and 2-year got inverted which increases the chance of recession.

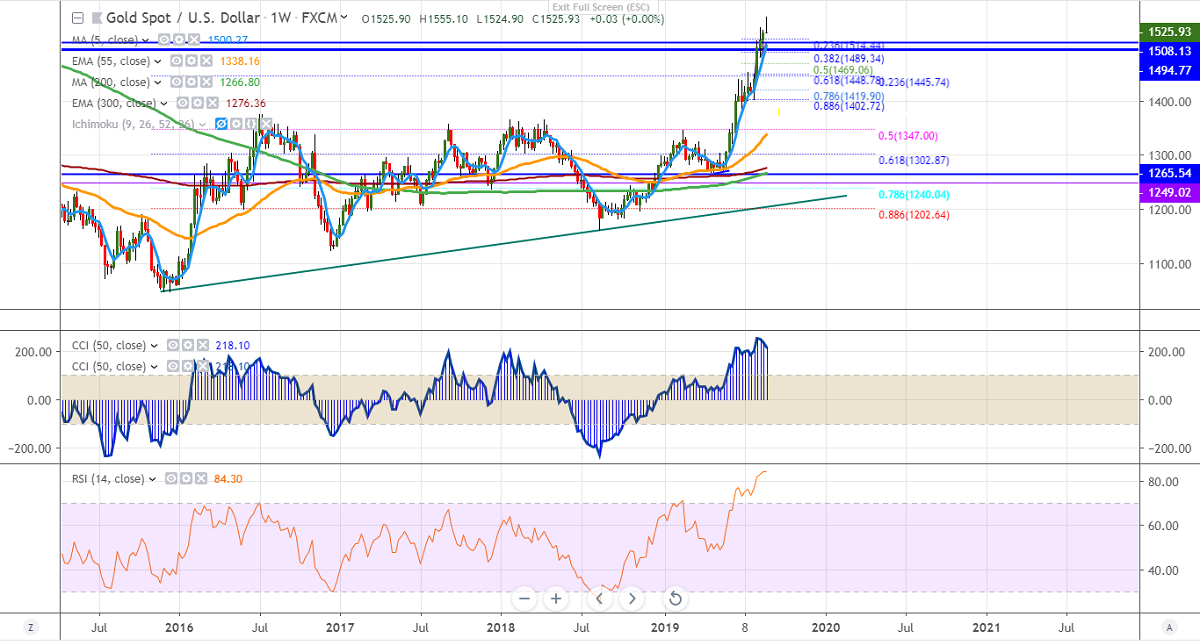

On the lower side, near term support is around $1514 (23.6% fib) and any violation below will drag the yellow metal down till $1500/ $1478 (5- W MA)/$1460 (7- W MA).

The near term resistance is around $1565 and the indicative break above targets $1580/$1600.

Momentum indicators RSI in the weekly chart is in the overbought zone and a slight decline can be used as a buying opportunity.

It is good to buy on dips around $1500 with SL around $1480 for the TP of $1560.