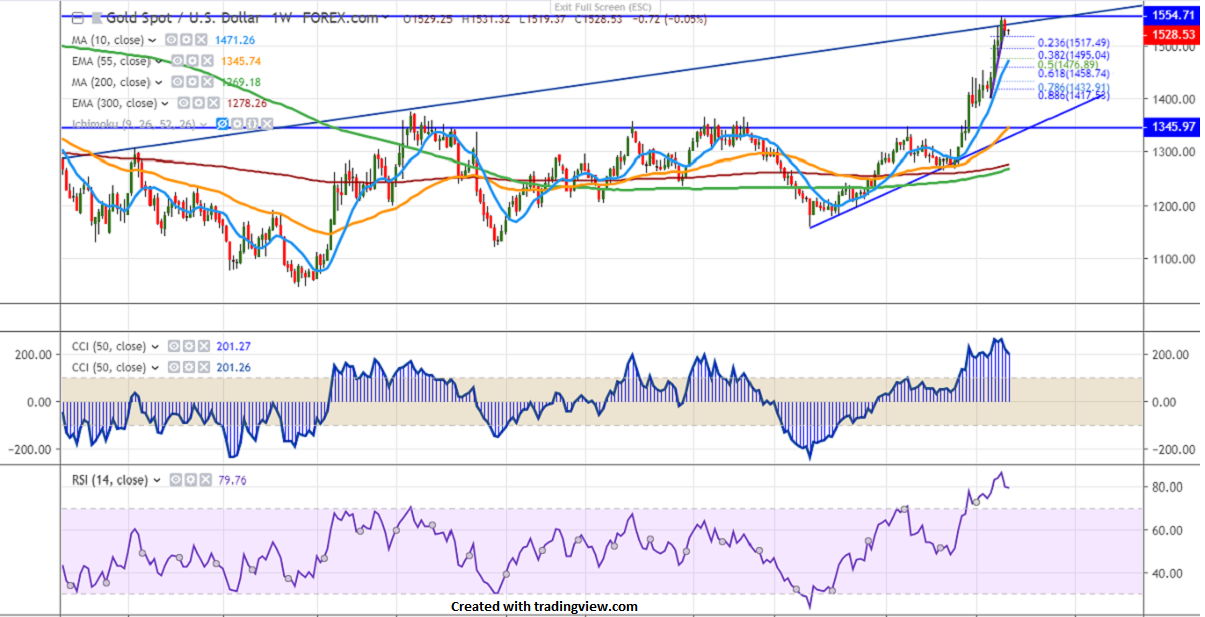

Major support- $1517

Gold is consolidating after hitting a 6-year high. It has shown a minor decline on profit booking. But the overall trend is still bullish on trade war escalation between the US and China. The US has imposed 15% tariffs on more than $125 bn of Chinese goods including footwear, smartwatches, etc which comes into effect from Sep 1st, 2019 and China retaliated by imposing additional tariffs on $75bn US. The yellow metal hits low of $1517 and is currently trading around $1527.

US 10 year bond yield shown a minor recovery of more than 7% after hitting a 3-year high. It is currently trading at 1.51%. Any break above 1.59% confirms minor bullishness.

On the lower side, near term support is around $1514-17 (23.6% fib) and any violation below will drag the yellow metal down till $1500/ $1480 (7- W MA)/$1457 (7- W MA).

The near term resistance is around $1555 and the indicative break above targets $1575/$1600.

Momentum indicators RSI in the weekly chart is in the overbought zone and a slight decline can be used as a buying opportunity.

It is good to buy on dips around $1500 with SL around $1480 for the TP of $1560.