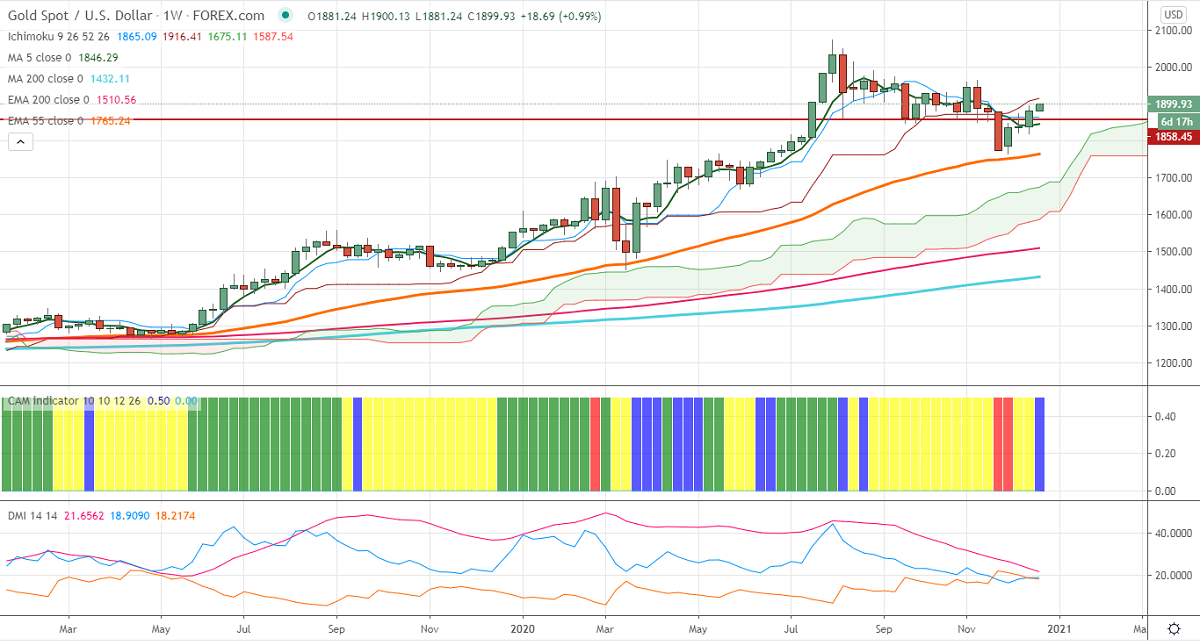

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1865

Kijun-Sen- $1908

Gold gained more than $80 in the previous week on US stimulus optimism. US lawmakers have reached a new stimulus package of $900 billion to individuals, businesses, and local government. The chance of Brexit deal is less likely in 2020 is also supporting yellow metal at a lower price. DXY showed a nice recovery of more than 80 pips from a low of 89.73. The US 10-year yield lost more than 3% from an intermediate top 0.956%.

Economic data:

US retail sales declined for the second consecutive months and dropped by -1.1% in November compared to a forecast of -0.3%. US flash manufacturing PMI came at 56.5 vs forecast of 55.90. US Fed has maintained its rates unchanged and voted to continue the monthly bond purchase of $120 billion until economic seen recovery.

Technical:

It is facing strong resistance at $1900, minor bullishness only above that level. Surge beyond targets $1925/$1950.On the lower side, near term support is around $1868, any indicative break below that level will take till $1850/$1822.

It is good to buy on dips around $1880 with SL around $1868 for the TP of $1925/$1950.