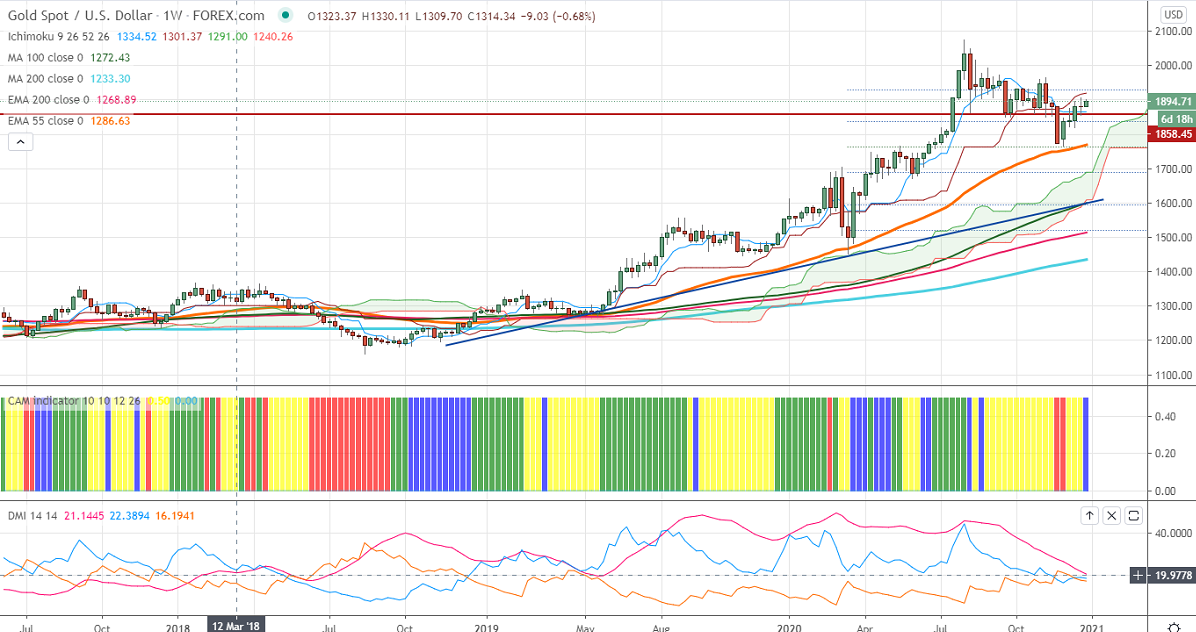

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1865

Kijun-Sen- $1916

Gold formed a Doji in the previous week due to the Christmas holiday mood. The US dollar declined after US President Trump signed the COVID stimulus package of $900 billion. The UK and EU have reached a post-Brexit deal in Brussels after 11-month negotiations. DXY is trading in a narrow range between 91.23 and 89.73 for the past 3 weeks. Any trend reversal only above 91.50. The US 10-year yield holding above the 0.90% level as US President signed the COVID stimulus package.

Economic data:

US Final GDP QoQ rebounded at a 33.4% annualized rate compared to an estimate of 33%. The conference board consumer confidence came at 88.6 vs forecast of 97.1. US durable goods orders rose for the seventh consecutive month, but at a slower pace at 0.9% compared to 1.8% the previous month.

Technical:

It is facing strong resistance at $1900, minor bullishness only above that level. Surge beyond targets $1925/$1950.On the lower side, near term support is around $1868, any indicative break below that level will take till $1850/$1822.

It is good to buy on dips around $1872-74 with SL around $1855 for the TP of $1925/$1950.