FxWirePro: Gold Weekly Outlook

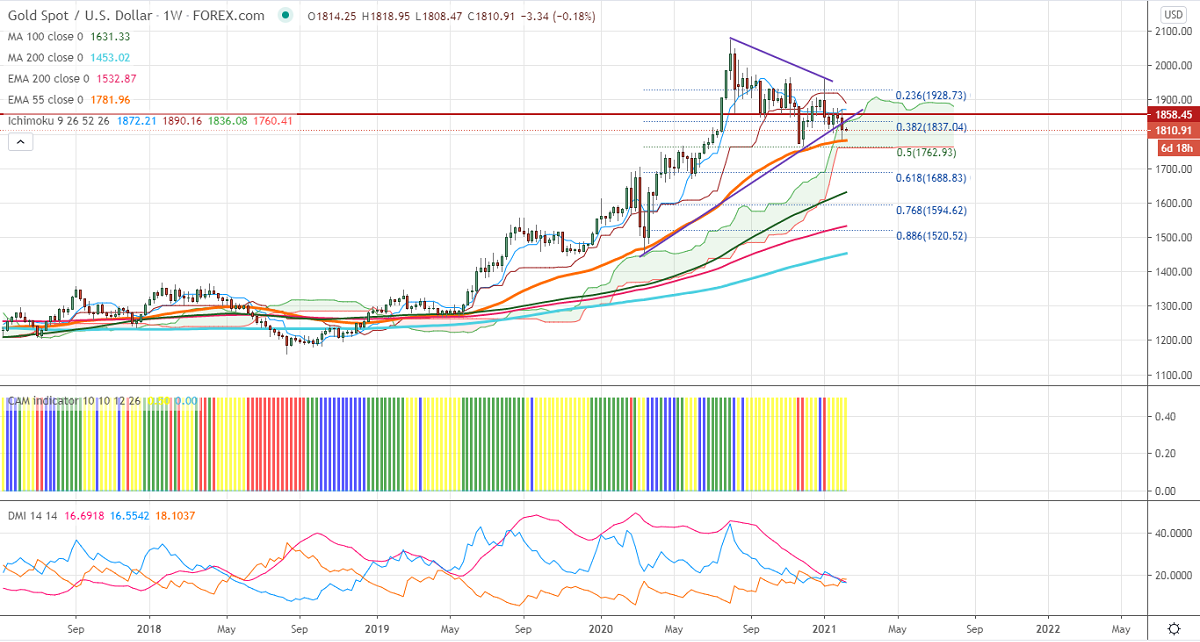

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1872

Kijun-Sen- $1907

Gold showed a massive sell-off from a high of $1871 on surging US dollar and US bond yield. The dollar index rose more than 100 pips till 91.60 and declined after weak Nonfarm payroll data. The US 10-year yield rose to the highest level since Mar 2020 in hopes of more stimulus aid.

Economic data:

US economy has added 49000 new jobs in Jan lower than the estimate of 85K. The December month data revised down to -227000. The unemployment rate declined to 6.3%vs 6.7%. US ISM manufacturing PMI came at 58.70 compared to an estimate of 60. The number of people who have filed for unemployment benefits declined to 779000 in the week ended Jan 30th vs a forecast of 828K.

Technical:

The pair faces strong support at $1780 (55-W EMA), violation below targets $1764/$1720. On the higher side, near term resistance is around $1822, any indicative break above that level will take till $1882/$1875.

It is good to sell on rallies around $1835-38 with SL around $1852 for the TP of $1760.