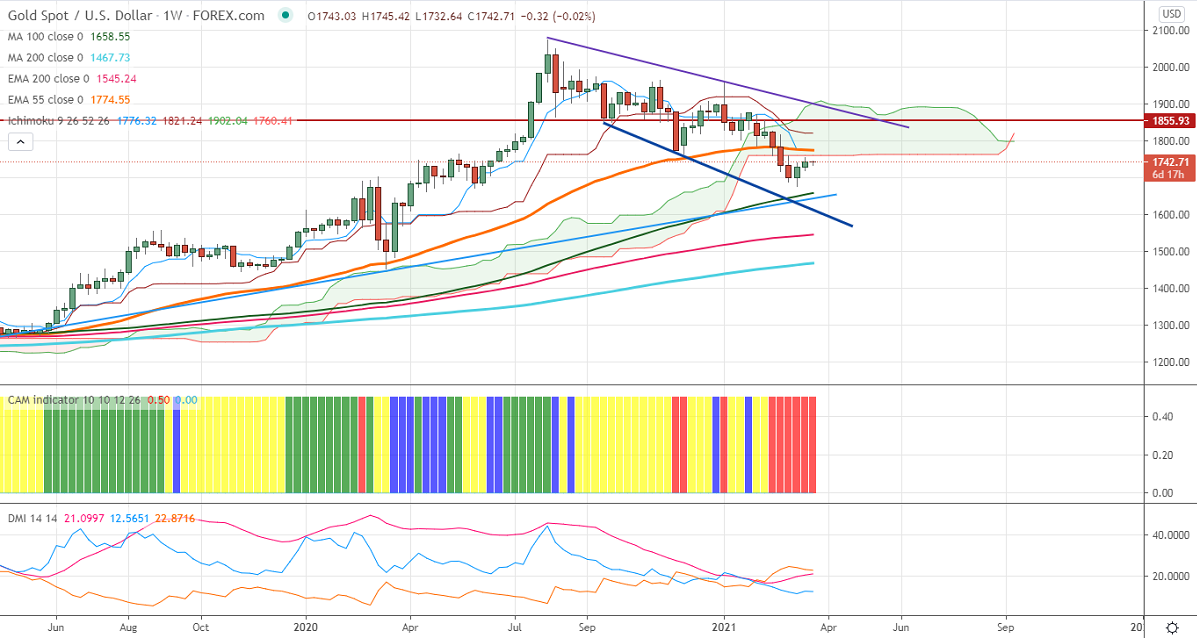

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1776

Kijun-Sen- $1821

Gold is trading slightly higher on minor weakness in US bond yield. The surge in the US dollar index is putting pressure on the yellow metal at higher levels. The US 10-year bond yield lost more than 3.5% after hitting a multi-month high. US dollar index is struggling to close above 92 levels, any violation above 92.20 confirms minor bullishness.

Economic data:

US Fed has kept its rates unchanged and upgraded US GDP, PCE for 2021. The Fed's dot plot shows that the rate hike is projected only in 2024. US retail sales dropped by 3% in Feb compared to a forecast of -0.5. The January data was revised to 7.6% from 5.3% as previously reported. The number of people who have filed for unemployment benefits rose to 77000 during the week ended Mar 13th. The Philly fed manufacturing index soared to 51.80 in Mar, the highest level in 50 years.

Technical:

It is facing strong support at $1729, violation below targets $1719/$1700/$1675. On the higher side, near-term resistance is around $1745, any indicative break above that level will take till $1760/$1783.

It is good to buy on dips around $1720-21 with SL around $1700 for the TP of $1760.