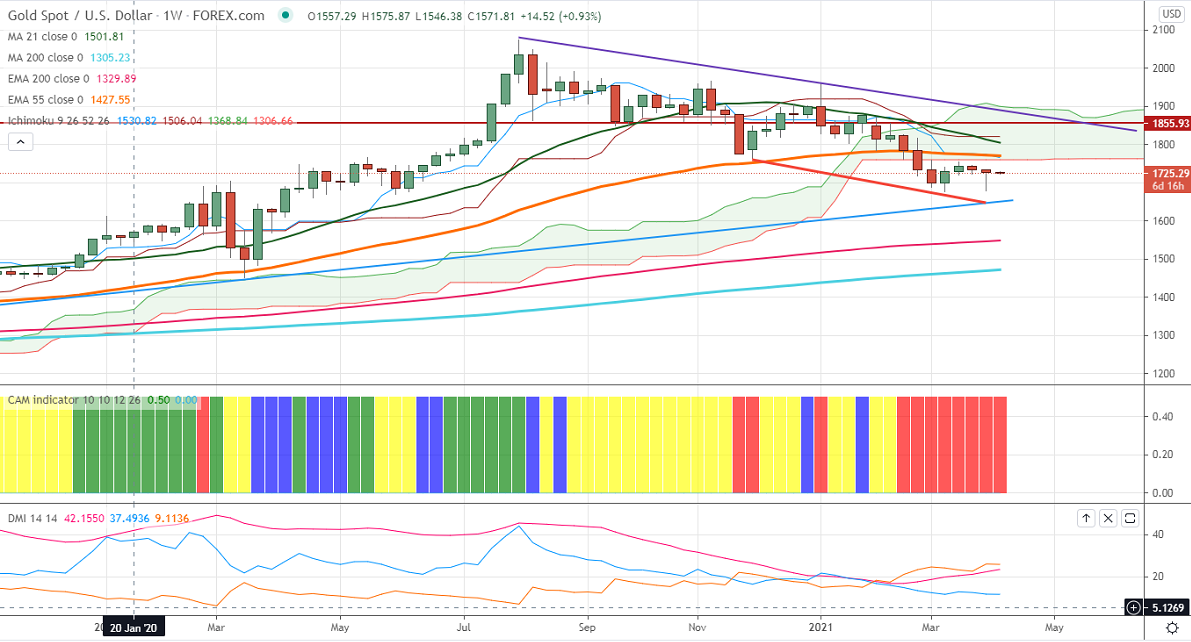

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1774

Kijun-Sen- $1821

Gold has formed a double bottom near $1675 and shown a minor recovery to $1730 on slight weakness in the US dollar. US dollar index lost more than 50 pips from a minor top 93.43. The upbeat US economic data and successful vaccine rollout in the US are supporting the US dollar. US 10-year yield is consolidating after hitting a high of 1.774%.

Economic data:

US Nonfarm payroll increased by 916K in Mar compared to a forecast of 652K. The unemployment rate came unchanged at 6.0% vs an estimate of 6.0%. Average hourly earnings showed a decline of 0.1% vs an estimate of 0.1%. The US IS Manufacturing PMI jumped sharply to 64.7 in Mar, the highest level in 37 years. The number of people who have filed for unemployment has jumped to 719000 last week compared to a forecast of 678K.

Technical:

It is facing strong support at $1675, violation below targets $1650/$1625. On the higher side, near-term resistance is around $1745, any indicative break above that level will take till $1760/$1783.

It is good to sell on rallies around $1744-45 with SL around $1760 for the TP of $1675.