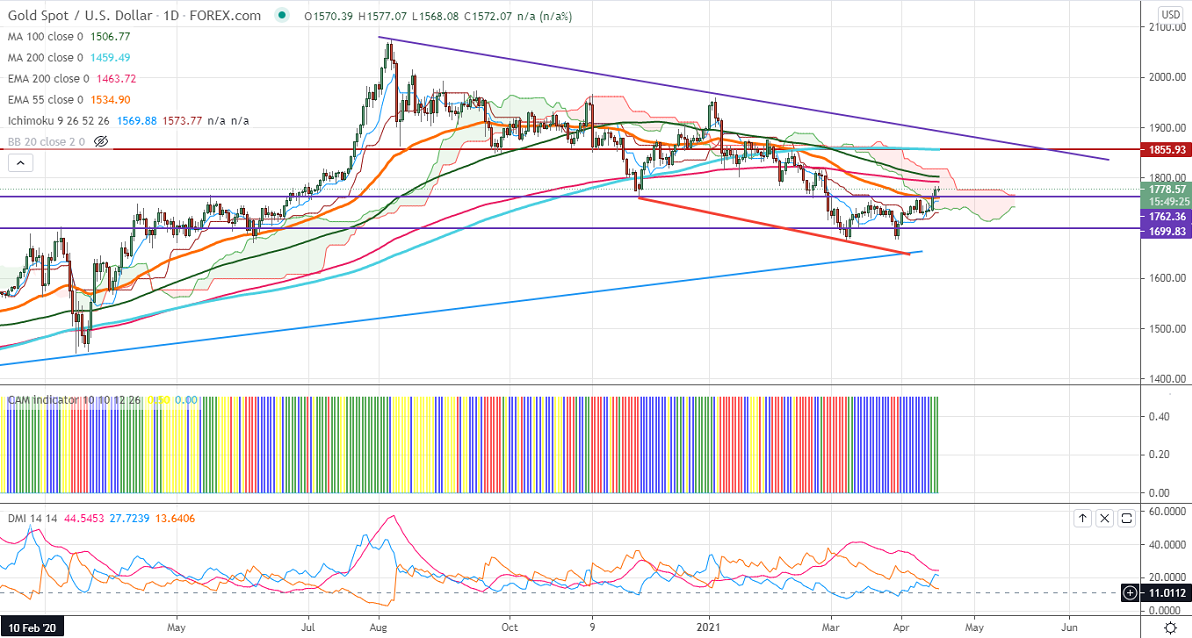

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1753

Kijun-Sen- $1730.92

Gold continues to trade higher and jumped more than $50 on broad-based US dollar weakness. The slight selling in US bond yield also supporting the yellow metal at lower levels. DXY has shown a minor recovery after hitting a low of 91.48. US 10-year yield lost more than 14% from temporary top 1.774%.

Economic data:

US CPI rose 0.6% in Mar compared to a forecast of 0.5%. The yearly inflation rose to 2.6% highest levels since the fall of 2018.US retail sales data surged to 9.8% in Mar compared to a forecast of 5.8%. The number of people who have filed for unemployment benefits declined to 576k in the previous week compared to an estimate of 703K

Technical:

It is facing strong support at $1760, violation below targets $1753/$1740/$1730. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1792, any indicative break above that level will take till $1802/$1810.

It is good to buy on dips around $1760 with SL around $1747 for the TP of $1793/$1802.