Ichimoku analysis (Weekly chart)

Tenken-Sen- $1760.15

Kijun-Sen- $1821

Gold jumped more than $70 on broad-based US dollar weakness. The US dollar index continues to trade lower for the fifth consecutive days and lost more than 300 pips on upbeat market sentiment and dovish comments by Fed chairman Powell. The minor pullback in US bond yields is putting pressure on yellow metal at higher levels. The US 10-year bond yield surged more than 8% from minor bottom 1.48%. the yellow metal hits a high of $1843 and is currently trading around $1834.

Economic data:

The US Non-Farm payroll raised by 266000 in Apr much below estimates of 990K and the unemployment rate increased to 6.1% from 6%. Average hourly earnings m/m surged to 0.7% vs estimate 0.0%. The number of private-sector jobs rose to 742000 in Apr compared to a forecast of 872K. The US ISM services PMI came at 62.7% in Apr slightly below the estimate of 64.2.

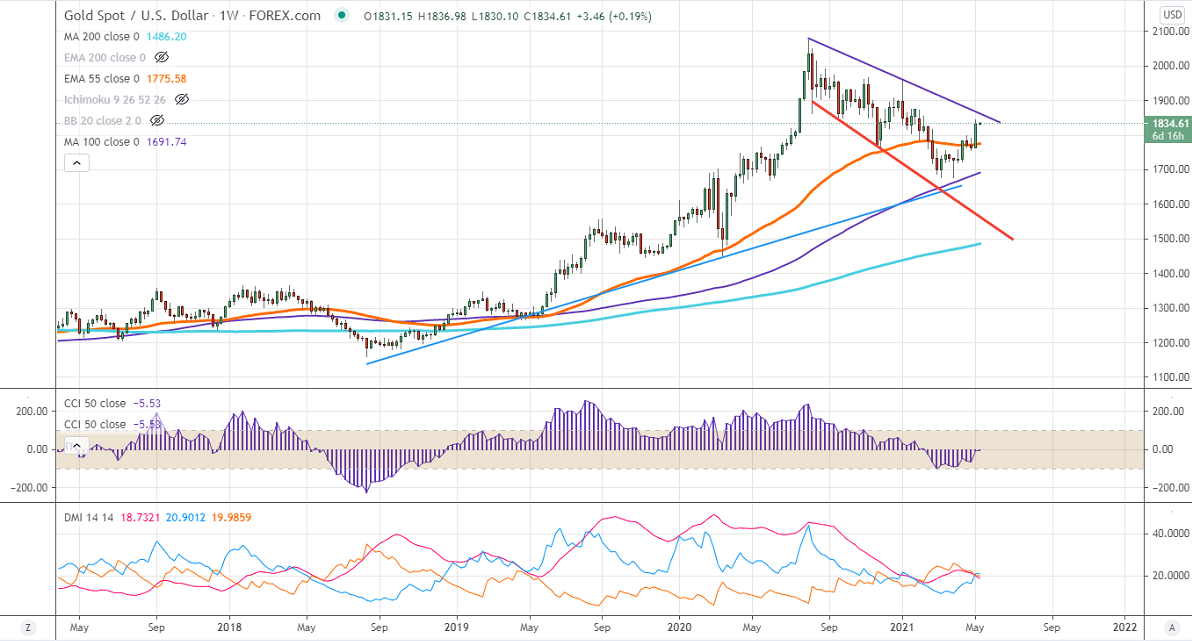

Technical:

It is facing strong support at $1820, violation below targets $1802/$1790/$1760. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1850, any indicative break above that level will take till $1870/$1900.

It is good to buy on dips around $1815-16 with SL around $1800 for the TP of $1870.