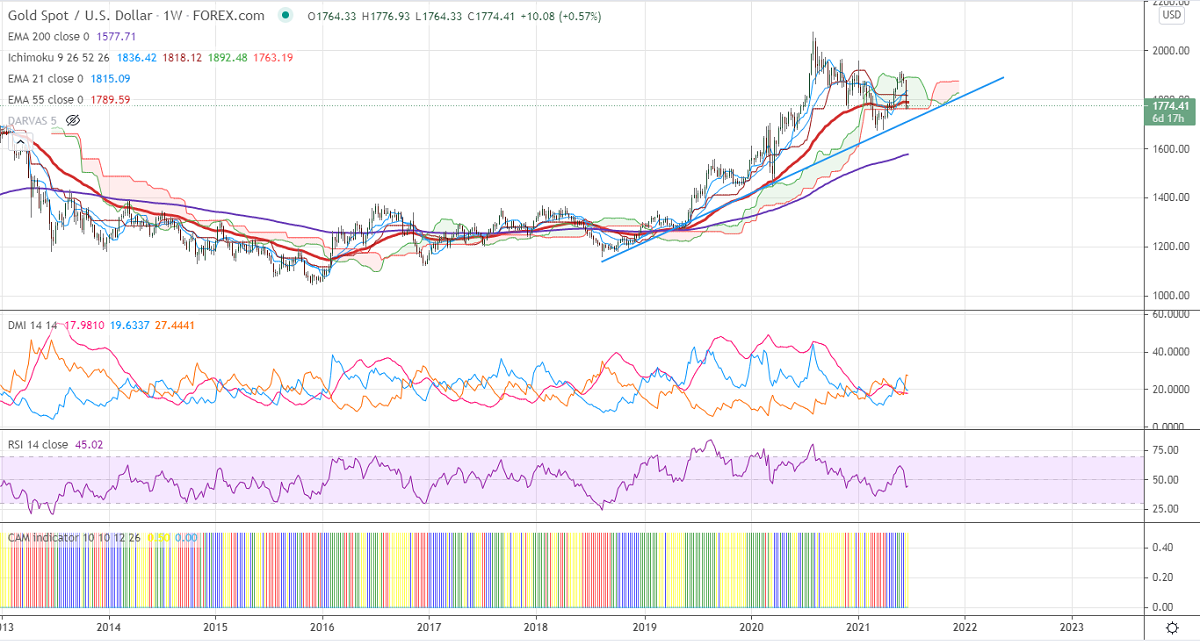

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1832

Kijun-Sen- $1838

Gold has shown a massive sell-off the previous week after the hawkish Fed. The US dollar index surged drastically more than 200 pips from a low of 90.34. The bond yields pared most of its gains made after the US Fed and lost more than 15%. Gold hits an intraday low of $1860 and is currently trading around $1864.34.

Economic data:

The central bank has kept its rates unchanged and has upgraded its growth and inflation outlook. The Fed dot plot shows that there will be two rate hikes in 2023. The US retail sales declined by 1.3% in May weaker than the forecast -0.6%. The core sales excluding auto, gasoline, building material declined by -0.7% vs an estimate of 0.4%.

Technical:

It is facing strong support at $1760, violation below targets $1740/$1720/$1700.Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1800, any convincing break above will take the yellow metal to $1825/$1836/$1860 is possible.

It is good to sell on rallies around $1800-01 with SL around $1825 for the TP of $1700.