FxWirePro- Gold Weekly Outlook

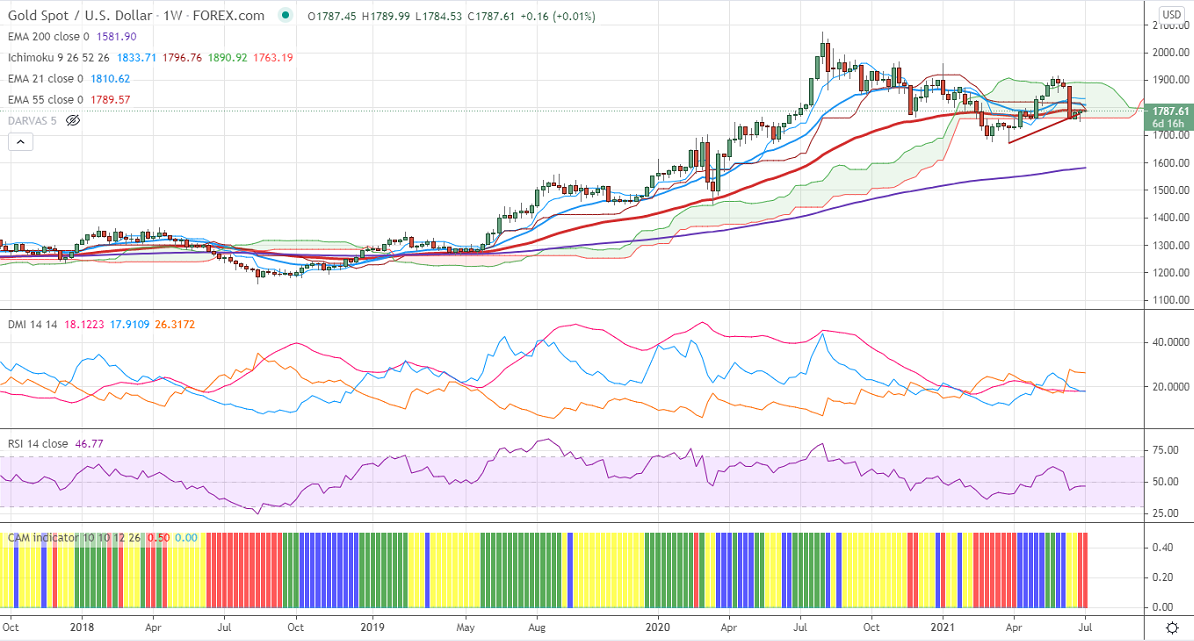

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1833

Kijun-Sen- $1818

Gold recovered slowly from a low of $1761.03 despite better than US Non-Farm payroll. The yellow metal has advanced to $1795 on minor selling in US dollars. DXY hits a high of 92.74 and has shown selling. The slight weakness in US bond yields also supporting the yellow metal at lower levels. It hits an intraday high of $1789.90 and is currently trading around $1787.

Economic data:

The US economy has added 850000 in June compared to a forecast of 725000, while the unemployment rate rose to 5.9% from 5.8%. US ISM manufacturing came at 60.6%, slightly below expectations of 61.

Technical:

It is facing strong support at $1760, violation below targets $1740/$1720/$1700. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1800, any convincing break above will take the yellow metal to $1825/$1836/$1860 is possible.

It is good to sell on rallies around $1800-01 with SL around $1825 for the TP of $1700.