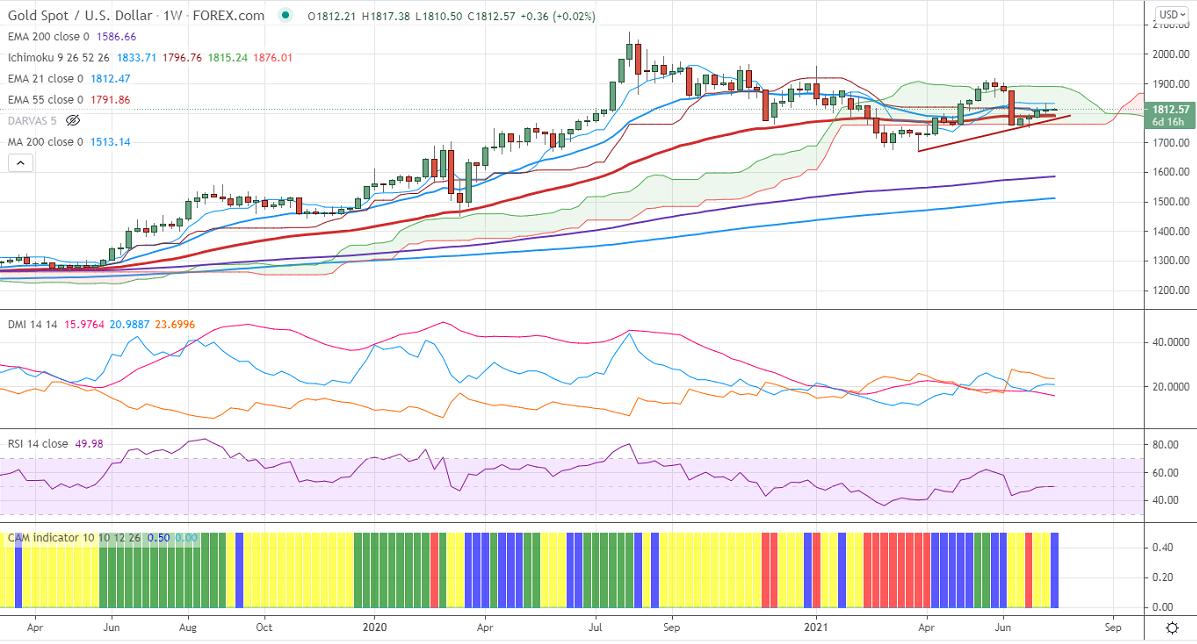

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1833

Kijun-Sen- $1796

Gold has lost more than $ 20 from a high of $1833 due to a pullback in the US dollar. The DXY is holding well above 92.50. Any breach above 92.75 confirms intraday bullishness. The US 10-year treasury yields dropped to 1.25%, the lowest level since early-2021 is preventing the yellow metal from further downside.

Economic data:

The Fed chairman Powell said to congress that a surge in inflation is temporary, but there are signs of cooling down. The US CPI m/m came at 0.9% and 5.4% from the same month earlier, the highest level since 2008. US retail sales rose 0.6% last month compared to a forecast of -0.4%.

Technical:

It is facing strong support at $1780, violation below targets $1760/$1740/$1720/$1700. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1836, any convincing break above will take the yellow metal $1860/$1900 is possible.

It is good to buy on dips around $1805-06 with SL around $1790 for the TP of $1850.