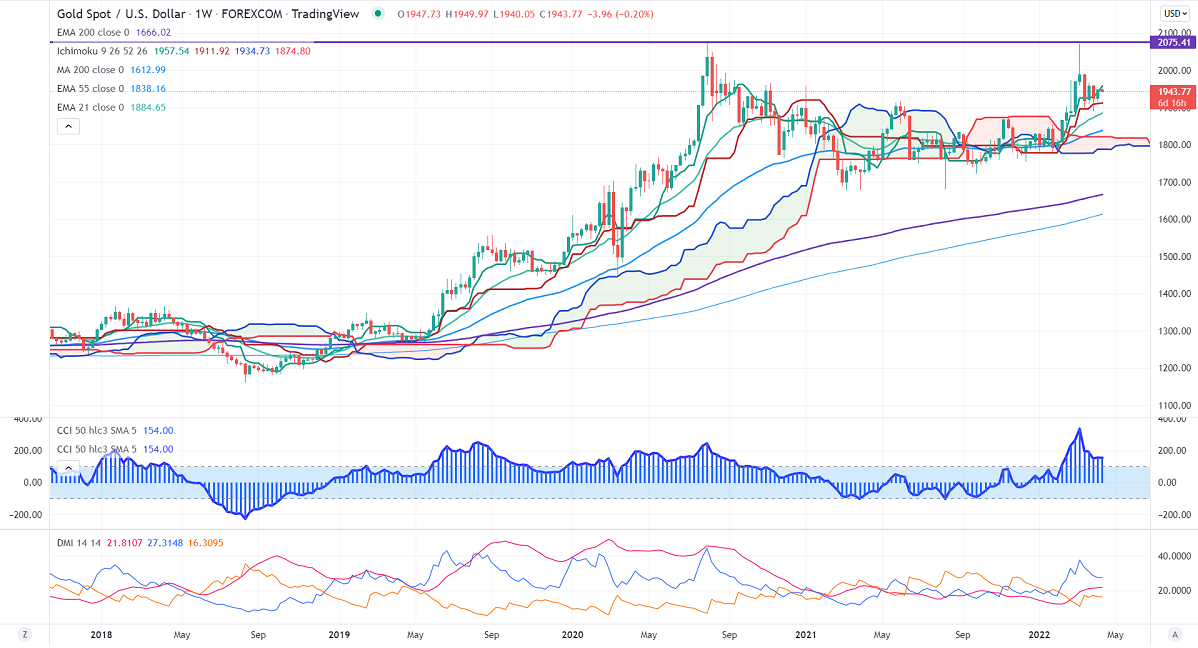

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1939

Kijun-Sen- $1910.25

Gold hits fresh month high despite surging US yield and dollar. The dollar index performed well against all majors after the Fed meeting minutes. The central bank revealed a plan for Quantitative tightening of USD 95 billion per month from May. US 10-year yield jumped sharply and hits the highest level since 2019. The yellow metal made an intraday high of $1949.95 and is currently trading around $1943.86.

The number of people who have filed for unemployment benefits declined to 166000 last week vs. an estimate of 201K.

Factors to watch for gold price action-

Global stock market- Flat (Neutral for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1928, violation below targets $1915/$1910/$1900/$1890. Significant reversal only below $1890. A dip to $1850/$1800 is possible. The yellow metal faces strong resistance of $1950, any breach above will take to the next level $1960/$1977/$2000/$2020.

It is good to sell on rallies around $1948-49 with SL around $1965 for TP of $1850.