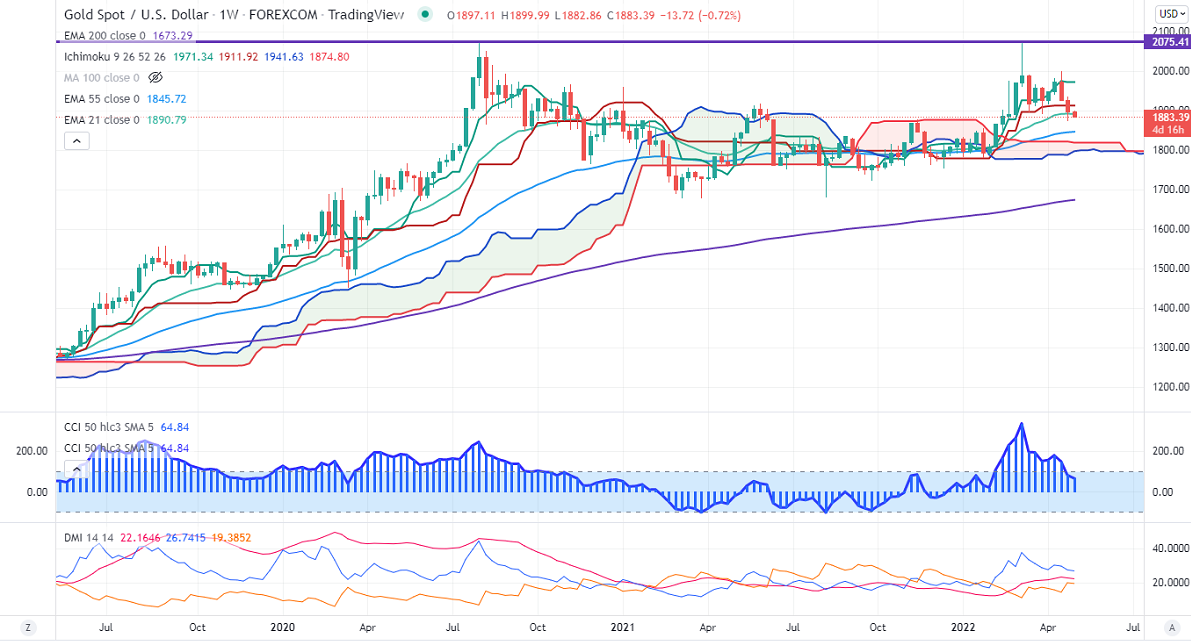

Ichimoku Analysis (Weekly Chart)

Tenken-Sen- $1971

Kijun-Sen- $1911.92

Gold continues to trade weak on the strong US dollar. Markets eye US Fed monetary policy this week for further direction. According to the Fed watch tool, the probability for a 50 bpbs rate hike in June has increased to 94.3% from 91.1% a week ago. US dollar index showed a profit booking after hitting a 20-year high in hopes of aggressive rate hikes. The yellow metal hits an intraday low of $1884 and is currently trading around $1885.

Major economic events this week are US NFP and ISM manufacturing index.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1870, a breach below targets $1850/$1800. Significant reversal only below $1750.The yellow metal faces strong resistance of $1920, any breach above will take to the next level $1932/$1950/$1970.

It is good to sell on rallies around $1900 with SL around $1925 for TP of $1750.