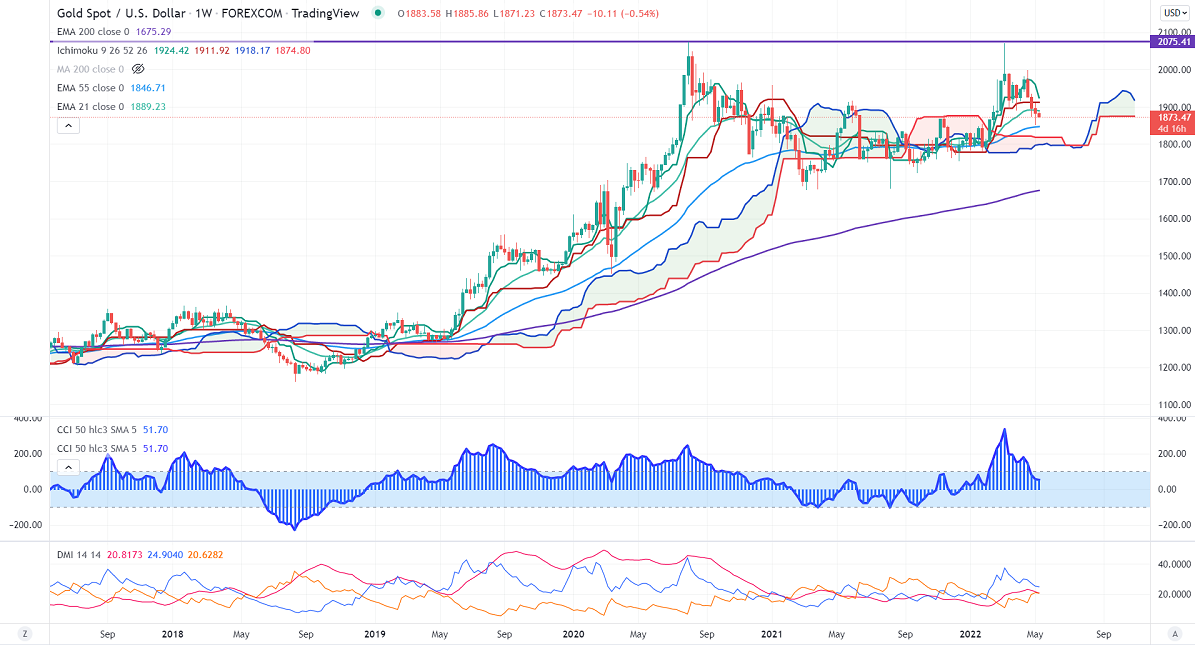

Ichimoku Analysis (Weekly Chart)

Tenken-Sen- $1960.45

Kijun-Sen- $1911.92

Gold consolidates in an arrow range between $1866 and $1892.50 for the past four days. Markets are highly volatile after major central bank decisions the previous week. RBA hiked rates by 25bpbs, Fed increased by 50 bpbs and Bank of England hiked by 25 bpbs for the fifth consecutive time. The surge in US bond yields and strong US dollar put pressure on the yellow metal at higher levels. It hits an intraday low of $1871.25 and is currently trading around $1872.42

US economy has added 428000 jobs in Apr compared to an estimate of 391000. The unemployment rate was unchanged at 3.6% vs . an estimate of 3.5%. The number of people who have filed for unemployment benefits rose by 20000 to 200000 for the week ended Apr 30, the highest since mid-Feb.

Factors to watch for gold price action-

Global stock market- bearish (positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1850, a breach below targets $1800/$1750. Significant reversal only below $1750.The yellow metal faces strong resistance of $1920, any breach above will take to the next level $1950/$1970.

It is good to sell on rallies around $1900 with SL around $1920 for TP of $1800.