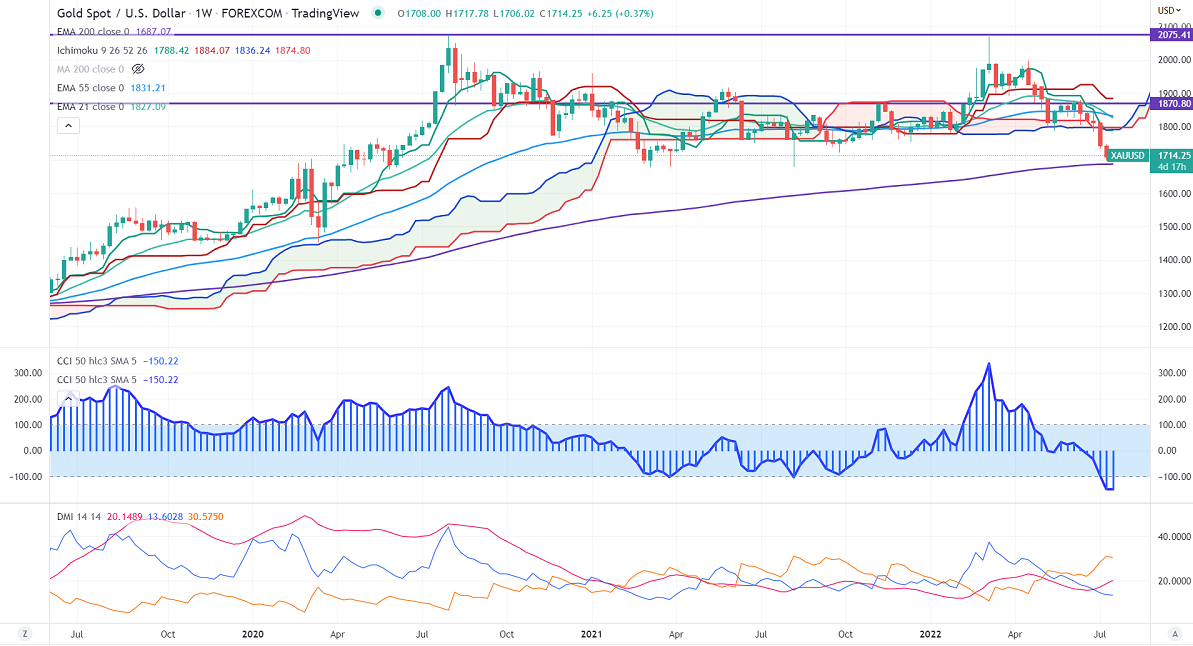

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1788.42

Kijun-Sen- $1884.07

Gold price lost its shine the previous week after surging US inflation. US CPI hits a 40-year high at 9.1% yearly in June compared to market expectations of 8.8%. US retail sales rose by 1% m/min June compared to a forecast of 0.70% The number of people who have applied for jobless benefits rose by 9000 last week to 244000 compared to a forecast of 235000. US dollar index showed a profit booking after hitting a multi-year high of 109.29. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Jul dropped to 71.5% from 92.4% a day ago.

Factors to watch for gold price action-

Global stock market- mixed (neutral for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- Mixed (neutral for gold)

Technical:

The near–term support is around $1700, a breach below targets $1650/$1600. Significant reversal only below $1600. The yellow metal faces minor resistance around $1720, any breach above will take it to the next level of $1732/$1745/$1770.

It is good to sell on rallies around $1728-30 with SL around $1760 for TP of $1650.