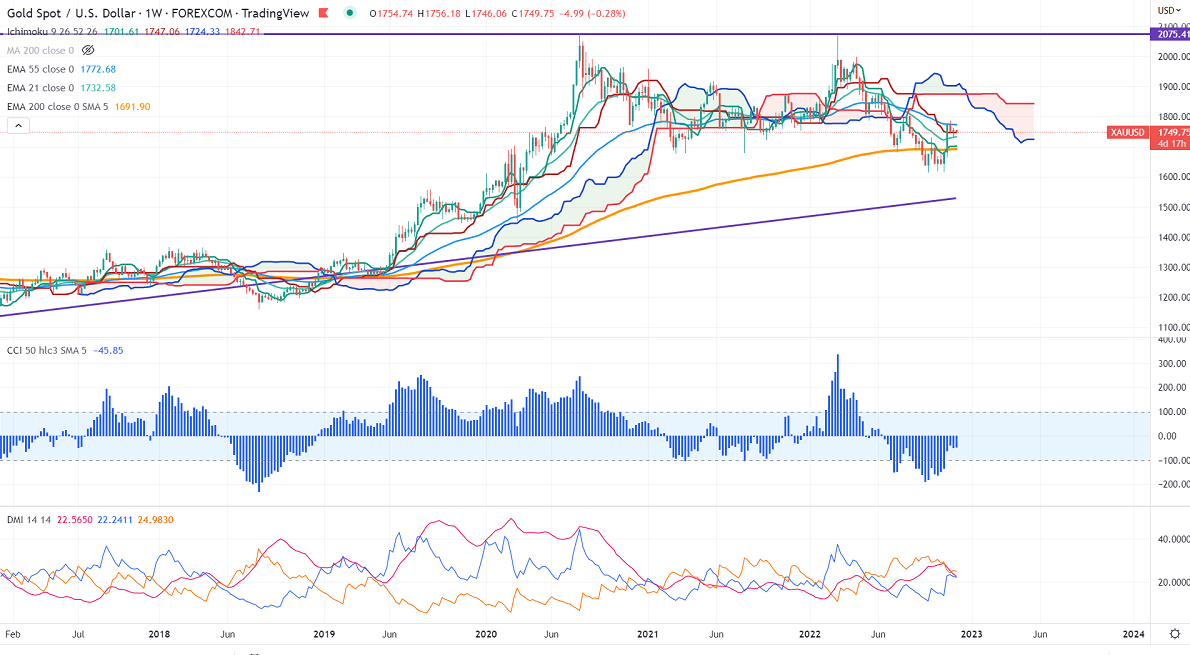

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1700.73

Kijun-Sen- $1747.06

Gold has shown a minor pullback the previous week after the FOMC meeting confirmed slowing the pace of rate hikes in the near term. Markets eye US Core PCE and NFP data this week for further direction dollar index halted its three weeks of a bearish trend and jumped nearly 80 pips from a low of 105.63.

Durable goods orders rose 1% in Oct vs. the forecast of 0.40%. The number of people who have filed for unemployment benefits increased by 17000 to 240000 in the week ended Nov 19 compared to a forecast of 225000.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Dec increased to 25.3% from 24.2% a week ago.

The US 10-year yield breaks significant support by 3.67% and hits a fresh 2-week low. The US 10 and 2-year spread widened to -78 basis points from -57 bpbs.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1730, a break below targets of $1720/$1700/$1680. The yellow metal faces minor resistance around $1760, breach above will take it to the next level of $1785/$1800.Minor bullish continuation only if it breaks $1803.

It is good to buy on dips around $1748-50 with SL around $1730 for TP of $1800.