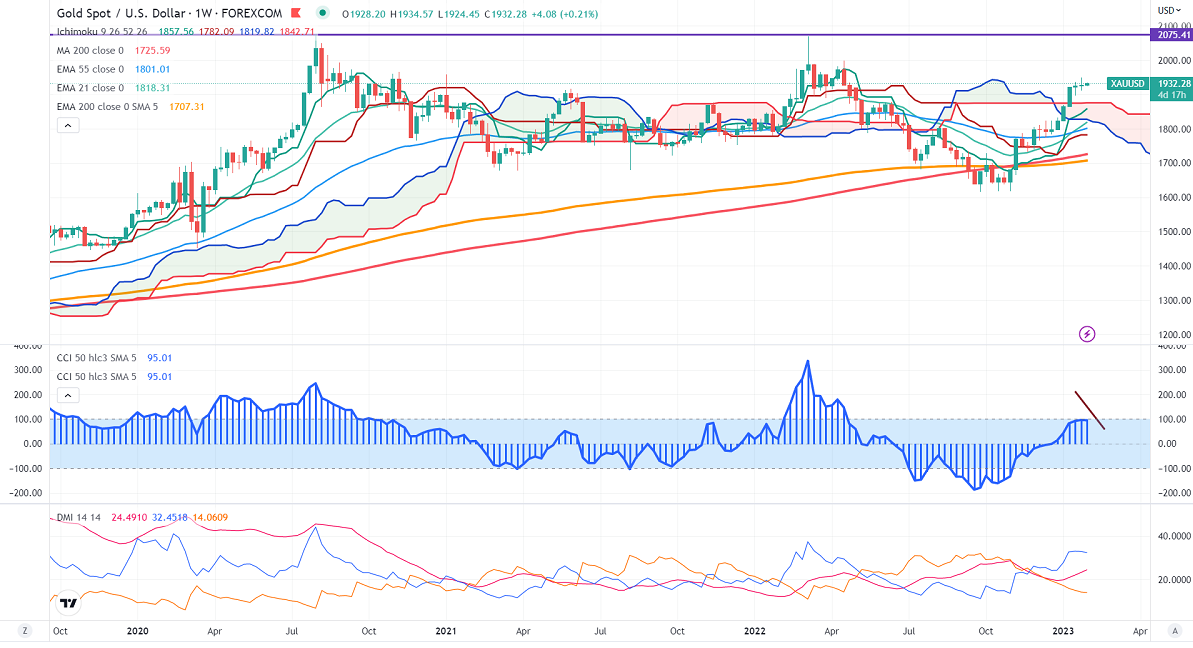

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1844.47

Kijun-Sen- $1782.07

Gold has traded in a narrow range between $1949 and $1916 for the past four days. The yellow metal showed a minor jump as US PCE rose 0.36% in Dec, above the previous month's 0.2%. It hits an intraday high of $1933.35 and is currently trading around $1933.40.

The US economy expanded at an annual rate of 2.9% in Q4, above expectations of 2.6%. The number of people who have filed for unemployment benefits in the week ending Jan 21 st compared to the forecast of 205K.

Markets eye to Fed, ECB, and BOE monetary policy report for further direction.

US dollar index- Bearish. Minor support around 101.50/100. The near-term resistance is 103.50/104.50.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb dropped to rose to 98.1% from 96.80% a week ago.

The US 10-year yield took support near 200-day MA and showed a minor jump. Any break and close below 3.26% confirm minor bearishness. The yield spread between 10 and 2-year narrowed to -70.6 basis points from -75 bpbs.

Factors to watch for gold price action-

Global stock market- bearish (bullish for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1890, a break below targets of $1865/$1825.The yellow metal faces minor resistance around $1935, and a breach above will take it to the next level of $1950/$1969.

It is good to buy on dips around $1890 with SL around $1880 for TP of $1935/$1950.