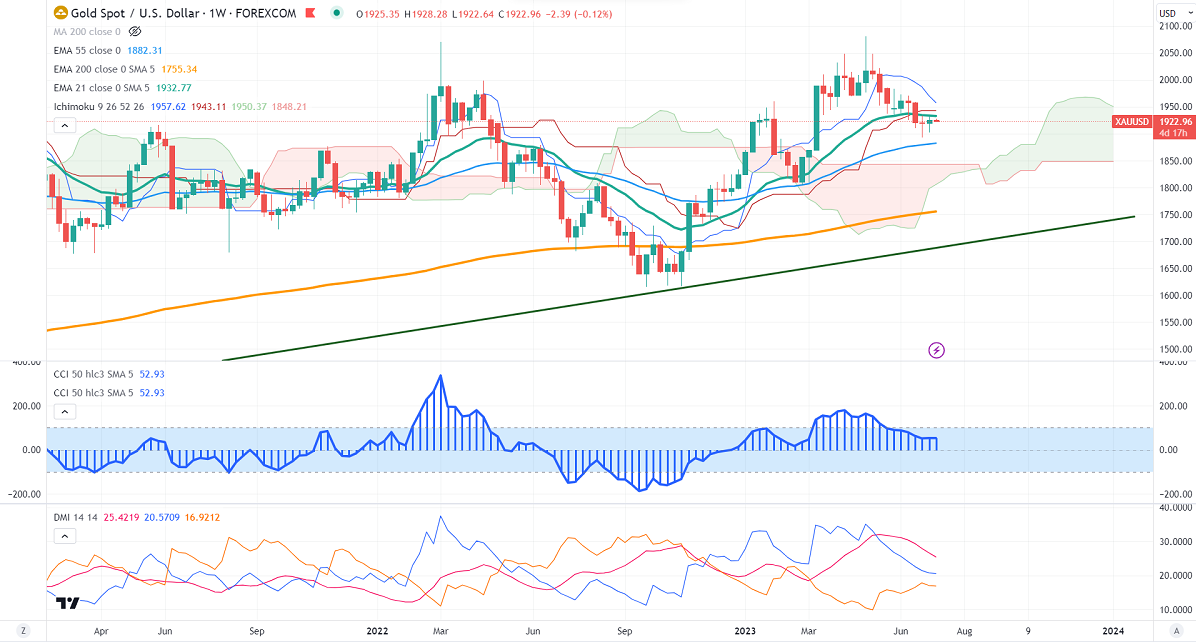

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1970.65

Kijun-Sen- $1943.11

Gold prices showed a minor pullback after weak US jobs data. The US economy added 209000 jobs in June, the lowest since Dec 2020. The unemployment rate declined to 3.6% from 3.7%. Average hourly earnings jumped 0.40% m/m, above the forecast of 0.30%. It hits a high of $1934.50 and currently trading around $1923.12.

US private sector payrolls have added 497000 jobs in June, well above expectations of 226000. US services PMI picked up faster in June to 53.9 Vs forecast of 51.30. US ISM manufacturing PMI declined in June to 46, compared to a forecast of 47.20 expected

Major economic data for the week

Jul 12th, 2023, US CPI m/m (12:30 pm GMT)

BOC Monetary policy (2:00 pm GMT)

Jul 13th, 2023, Core PPI m/m (12:30 pm GMT)

Jul 14th, 2023, Prelim UoM consumer sentiment

US dollar index- weak. Minor support around 101.80/101. The near-term resistance is 103/103.60.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 92.40% from 86.80% a week ago.

The US 10-year yield hits the highest level since 2007 despite weak US jobs data. The US 10 and 2-year spread narrowed to -86.80% from -110%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Bearish (Positive for gold)

US10-year bond yield- Bullish (Bearish for gold)

Technical:

The near–term support is around $1900, a break below targets of $1890/$1878/$1868/$1850.The yellow metal faces minor resistance around $1936, and a breach above will take it to the next level of $1942/$1950/$1955.

It is good to sell on rallies around $1928-30 with SL around $1950 for TP of $1878.