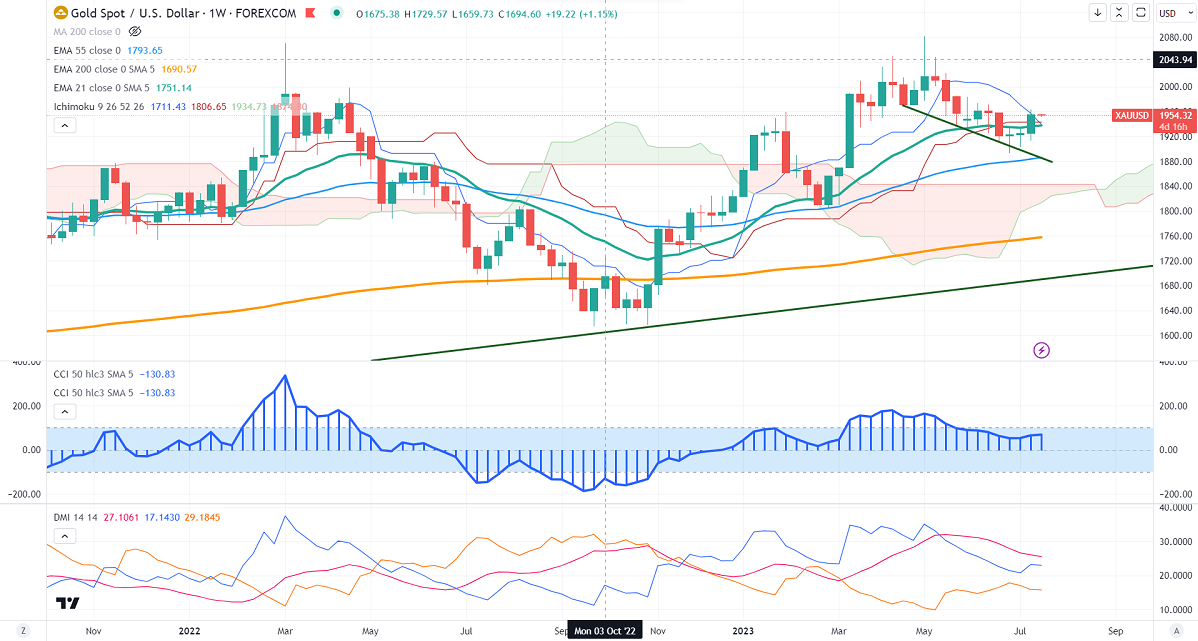

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1957.62

Kijun-Sen- $1943.11

Gold prices showed a minor sell-off after a $50 jump from a low of $1912. The yellow metal gained sharply after weak US inflation. It hits a high of $1963.42 and currently trading around $1952.30.

US CPI declined to 3% YoY in June, compared to a forecast of 3%. On a monthly basis, inflation dropped to 0.2% vs. the forecast of 0.30%. The Producer prices for the month dropped to 0.10% YoY, compared to a forecast of 0.40%. Core PPI m/m declined to 0.10% vs the forecast of 0.20%. The University of Michigan's consumer sentiment rose in Jul to 72.60, compared to a forecast of 65.50.

Major economic data for the Week

Jul 17th, 2023, US empire state manufacturing Index (12:30 pm GMT)

Jul 18th, 2023, Core Retail sales m/m (12:30 pm GMT)

Jul 19th, 2023, US Building permits (12:30 pm GMT)

Jul 20th, 2023, US Initial jobless claims (12:30 GMT)

Philly fed manufacturing index

US dollar index- weak. Minor support around 99.50/98. The near-term resistance is 101/102.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 96.10% from 93% a week ago.

The US 10-year yield is trading weak for the fourth consecutive day. The US 10 and 2-year spread narrowed to -93.60% from -110%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Bearish (Positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1950, a break below targets of $1945/1930. The yellow metal faces minor resistance around $1965, and a breach above will take it to the next level of $1980/$2000.

It is good to buy on dips around $1950 with SL around $1940 for TP of $1990/$2000.