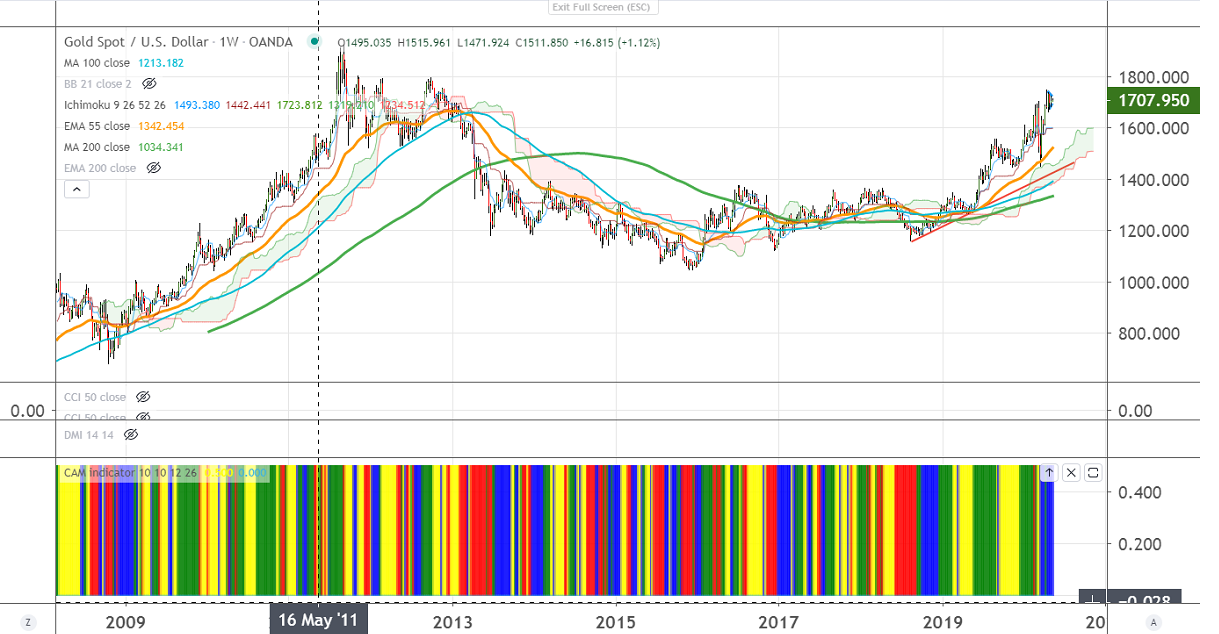

Ichimoku Analysis (Weekly Chart)

Tenken-Sen- $1599

Kijun-Sen- $1596

Gold lost more than $20 despite weak US jobs data. US economy lost nearly 20 .5 million jobs in Apr vs forecast of -22 million and the unemployment rate at 14.7%, the highest level since the 1930s. The Broader U6 unemployment rate surged to record 22.8% from 8.7%.

US Dollar index – weak (positive for Gold)

S&P500-Slightly positive (negative for gold)

US Bond yield- Slightly bullish (negative for gold)

The yellow metal to trade steady as dismal jobs data increases the hope of more stimulus from the US Fed.

On the flip side, the near term significant support is around $1700 and any violation below will drag the gold down till $1688 (trend line support)/$16.

The immediate resistance is around $1723, any indicative break beyond targets $1747. Significant trend continuation can be seen only if it breaks $1747.

It is good to buy on dips around $1707-08 with SL around $1696 for the TP of $1747.