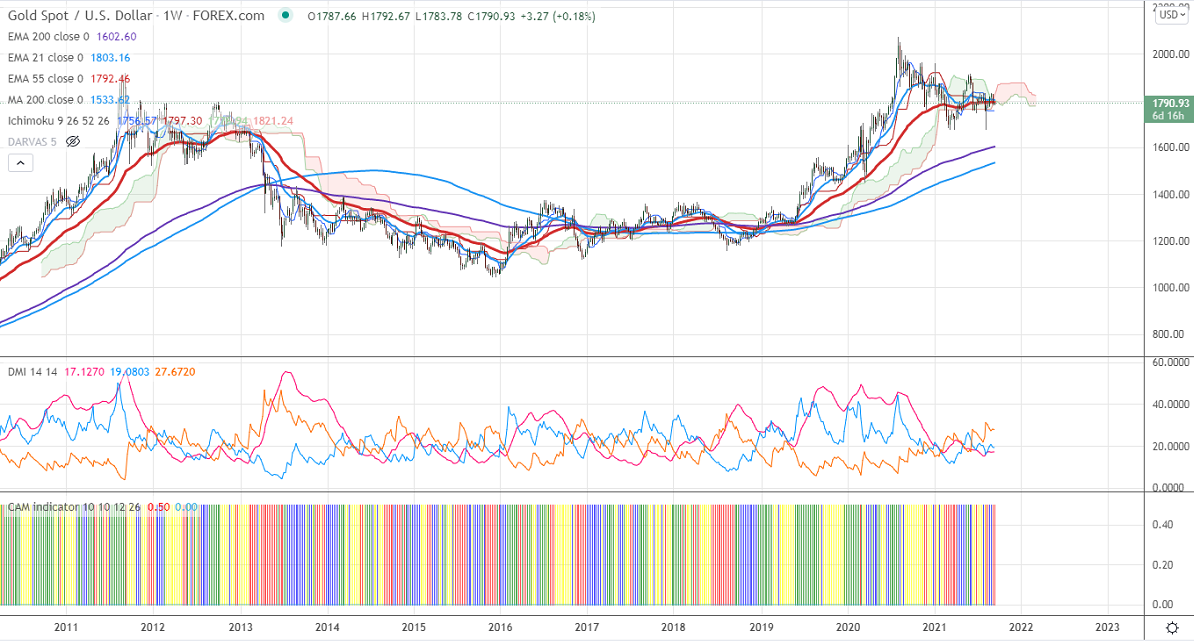

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1756

Kijun-Sen- $1797.30

Previous week High- $1830.33

Previous week low- $1782

Gold has lost more than $50 the previous week on board-based US dollar buying. The surge in US treasury yields also preventing the yellow metal from further upside.DXY is holding above 92.50, any breach above 92.75 confirms further bullishness. The yellow metal hits a low of $1782 and is currently trading around $1791.15.

Economic data-

The number of people who have filed for unemployment benefits dropped to 310000 last week compared to an estimate of 343K. The European Central bank has kept its rates unchanged and to a moderately lower pace of bond-buying program compared to the previous quarter.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The immediate resistance is around $1810 and a convincing break above will take the yellow metal $1821/$1835/$1850/$1860/$1877/$1900 is possible. It is facing strong support at $1770, violation below targets $1750/$1725.

It is good to sell on rallies around $1818-20 with SL around $1835 for TP of $1750.