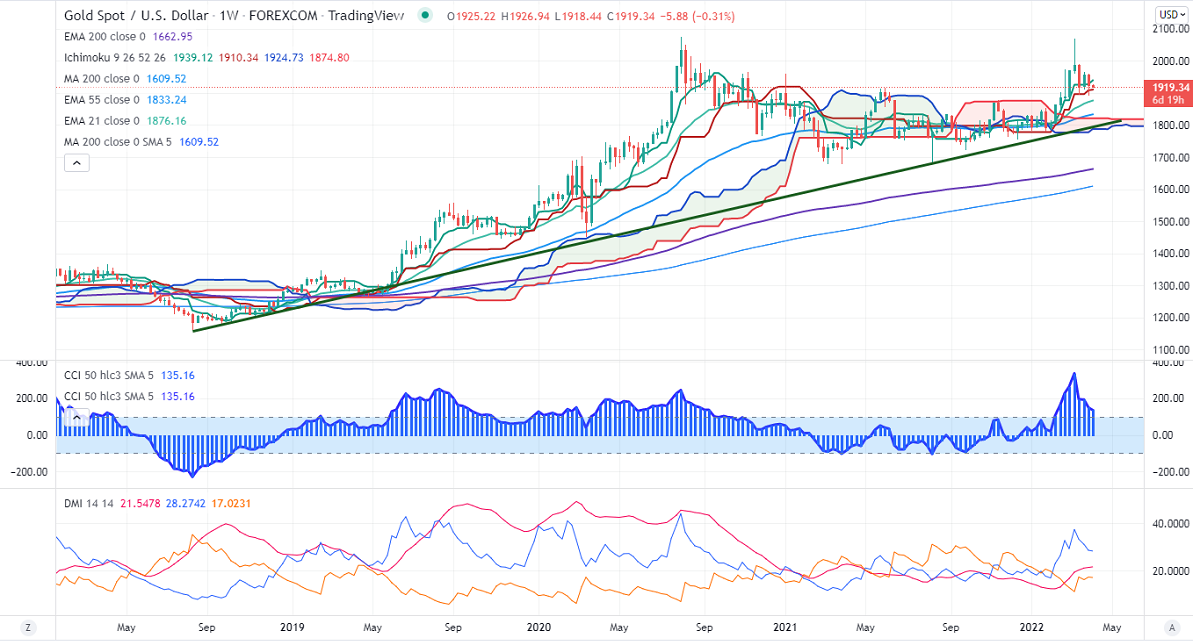

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1928.06

Kijun-Sen- $1908.22

Gold lost its shine after upbeat US jobs data. US economy has added 43100 jobs in Mar compared to a forecast of 492K and the unemployment rate declined to 3.6% from 3.7%. The US 10-year yield recovered to 2.4195% after the data. The yellow metal hits an intraday low of $1918 and is currently trading around $1919.61.

US Fed's favorite measure PCE climbed 6.4% in the year through Feb, the fastest level since 1982.

Factors to watch for gold price action-

Global stock market- Flat (Neutral for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1918, violation below targets $1910/$1895/$1877/$1850/$1800. Significant reversal only below $1750.The yellow metal faces strong resistance of $1930, any breach above will take to the next level $1950/$1977/$2000/$2020.

It is good to sell on rallies around $1928-30 with SL around $1950 for TP of $1850.