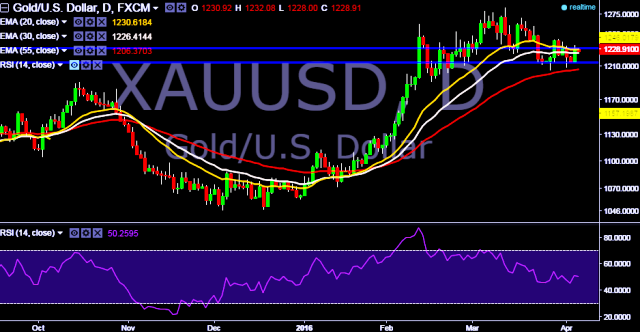

- XAU/USD is currently trading around $1228 mark.

- It made intraday high at $1230 and low at $1228 levels.

- Intraday bias remains bullish till the time pair holds key support at $1222 marks.

- On the top side, initial resistance is seen at $1232 mark.

- Expected trading range for the day is $1225 - $1242 marks.

- A daily close above $1232 is required to turn the bias bullish again.

- On the top side, key resistances are seen around $1232, $1247 and $1252 levels.

- Alternatively, a sustained break below $1222 will drag the parity down towards key support levels at $1214, $1208, $1202 and $1190 marks.

We prefer to take long position in XAU/USD only above $1230, stop loss $1222 and target $1242 marks.