- Gold recovered slightly after hitting a low of $1322.53 after U.S dollar declined slightly after minor jump. The yellow metal jumped almost $12 from the low of $1322.It is currently trading around $1330.55.

- The yellow metal gained sharply in previous week and hits fresh year high at $1357.50. But slight decline in this week was due to profit booking. The downside is limited due to geopolitical tensions in North Korea.

- DXY has shown a minor selling after a huge recovery till 92.08 yesterday. Any break above 93.11 confirms minor bullishness a jump till 94.15 likely. Major trend reversal can be seen only above 94.15 level. The minor resistance is around 92.29/92.63 (20- day MA).

- U.S 10 year yield huts 2- week high ahead of U.S 10 –year auctions. It is currently trading around 2.17%.

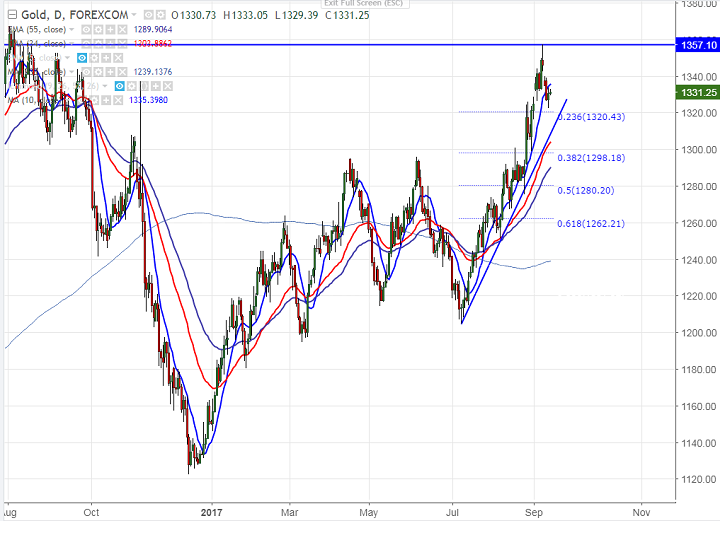

- Technically gold is facing minor resistance around $1334.38 (10- day MA)and any break above will take the yellow metal to new year high at $1343/$1350/$1358.

- Gold’s near term support is around $1320 (23.6% retracement of $) and break below will drag the commodity down till $1320 (23.6% retracement of $1204 and $1358)/$1313/$1300.The yellow metal should break below $1250 for minor trend reversal.

It is good to sell gold on rallies around $1330-32 with SL around $1338 for the TP of $1313/$1301..