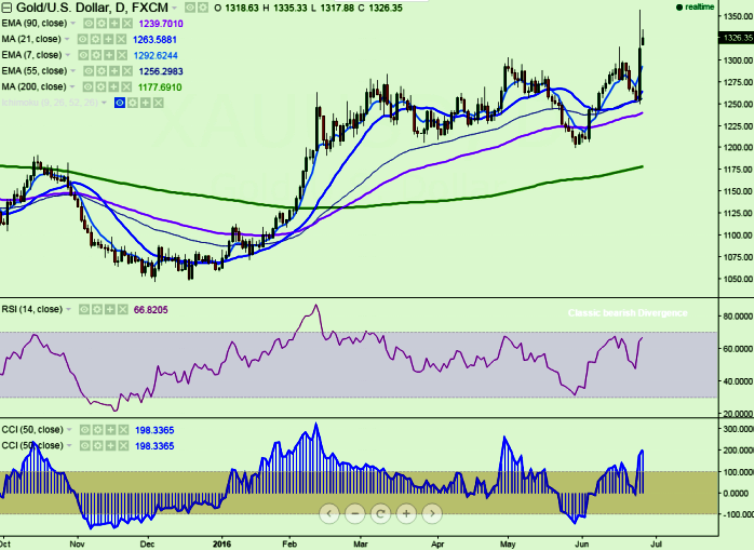

- Major support- $1290 (61.8% retracement $1250 and $1358)

- Gold has slightly retreated after making a high of $1358.It is currently trading around $1326.

- On the lower side, major short-term support is around $1290 and any violation below will drag the commodity down till $1280 (7 day EMA)/ $1257 (21 day MA)/$1250 (Jun 23rd low).

- Overall bullish invalidation only below $1200.

- The major resistance is around $1358 (Jun 24th high) and any break above targets $1372/$1390 (161.8% retracement of $1358 and $1306).

It is good to buy at dips around $1315-$1320 with SL around $1290 for the TP of $1357/$1391.