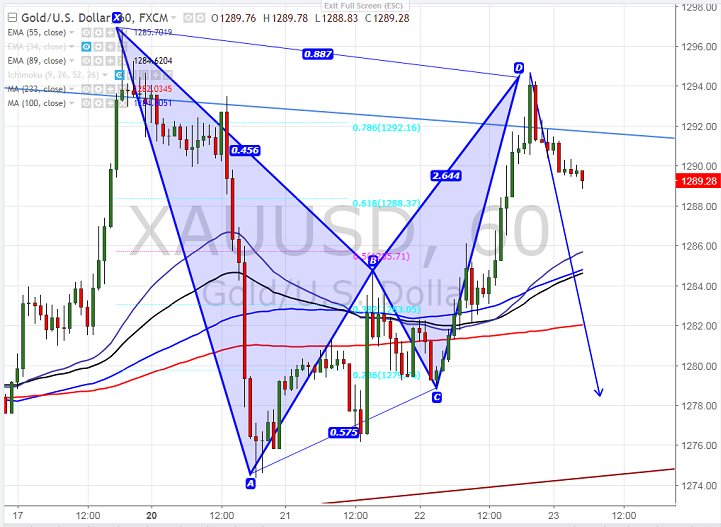

- Harmonic pattern formed – Bearish Bat pattern

- Potential Reversal Zone (PRZ) - $1297.

- Gold has jumped sharply after FOMC minutes meeting. The yellow metal jumped till $1294.50 after Fed minutes showed concerns over weak inflation .The rate hike in Dec is confirmed but there are growing doubts over three more hikes in 2018. US dollar index broken major support at 93.40 (50- day MA) and dipped till 93.16 at the time of writing.

- The yellow metals has formed Bearish Bat pattern and any major bullishness can be seen only above $1297. Any break above will take the gold to next level till $1300/$1309 in the short term.

- On the lower side, near term resistance is around $1281 (233- H MA) and any violation below will drag the commodity to next level till $1274/$1267. Short term weakness can be seen only below $1262.

It is good to sell on rallies around $1289-$1291 with SL around $1297 for the TP of $1281/$1274.