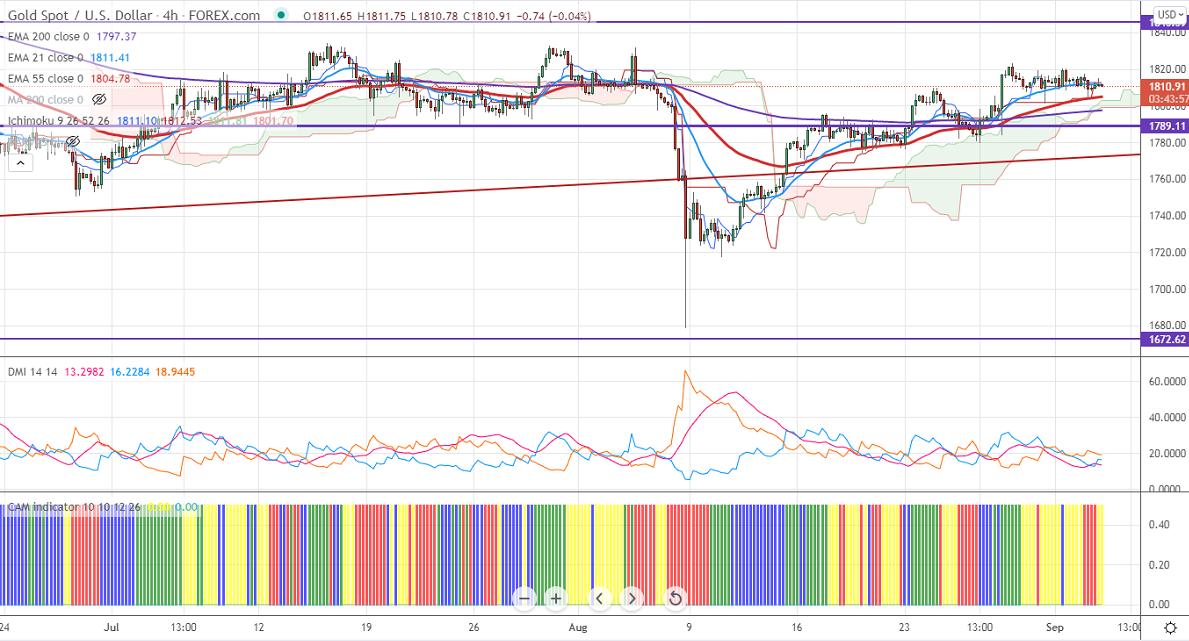

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1811.10

Kijun-Sen- $1812.53

Previous week High- $1795

Previous week low- $1770

Gold is trading flat ahead of US Nonfarm payroll data. The US economy is expected to add 72000 jobs in August compared to the previous month's 943K. Any weakness in US jobs figures might delay Fed bond tapering. It will harm the US dollar. The US dollar index continues to trade weak for fifth consecutive days and holding below the 92.40 level. Any breach below 92 confirms bearishness.

Economic data-

The number of people who have filed for unemployment benefits declined to 340000 for the week ended Aug 28th, compared to a forecast of 345000.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- mixed (neutral for gold)

Technical:

The immediate resistance is around $1825 (38.2% fib), a convincing break above will take the yellow metal to $1835/$1850. It is facing strong support at $1770, violation below targets $1750/ $1730/$1700.

It is good to buy on dips around $1800 with SL around $1790 for TP of $1835.