FxWirePro- Gold trades higher on risk aversion mood, good to buy on dips

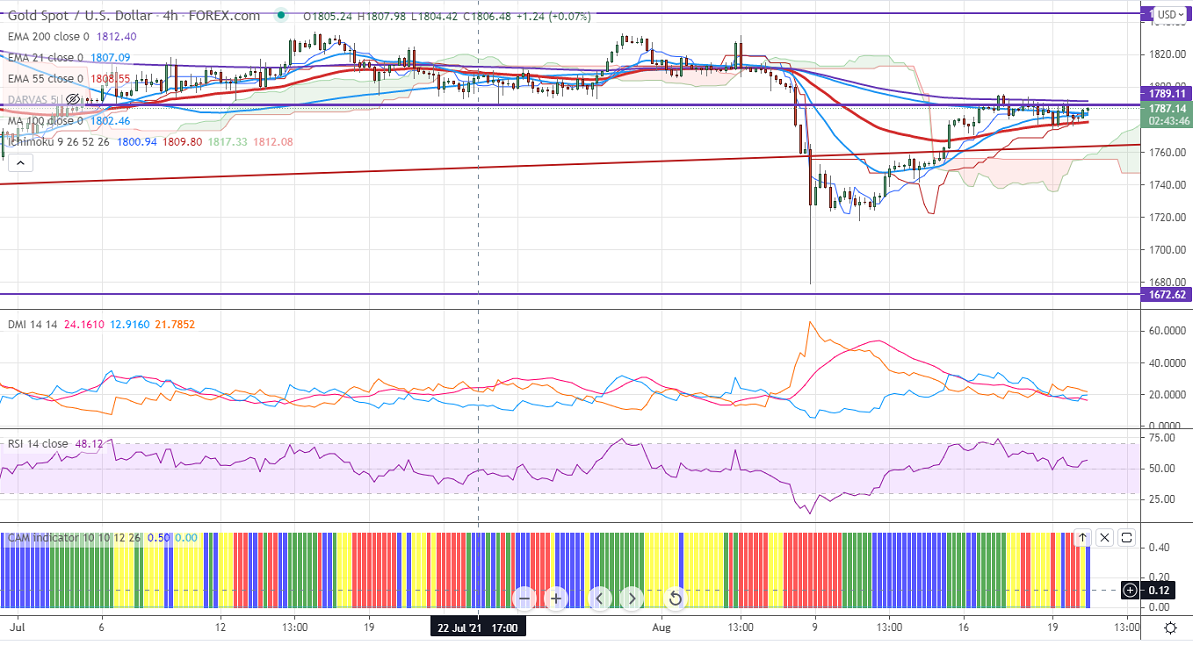

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1783.54

Kijun-Sen- $1783.24

Gold is holding above the $1780 level despite a strong US dollar index. The increase of risk aversion due to the spread of delta variant coronavirus and the Afghanistan political crisis is supporting yellow metal. The US dollar index surged more than 100 pips this week and hits a 4-1/2 month high. The US10-year yield lost more than 5% on COVID concerns and Fed taper talk. The yellow metal hits a high of $1786.67 and is currently trading around $1786.

The Philly Fed manufacturing index fell to 19.4 compared to a forecast of 23.20, the lowest level since December. The number of people who have filed for unemployment benefits declined by 29000 to 348000,17-month low.

Factors to watch for gold price action-

Global stock market- Weak (positive for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- mixed (neutral for gold)

Technical:

The immediate resistance is around $1800, a convincing break above will take the yellow metal $1835/$1860 is possible. It is facing strong support at $1770, violation below targets $1762/$1750.

It is good to buy on dips for around $1775-76 with SL around $1760 for TP of $1831.