We think the booming time for Swiss franc as their inflation has been stagnant, the major driving factor behind our long-term CHF view is Switzerland's inflation outlook which will allow the SNB to keep its nominal rates lowest in the world.

Last Swiss CPI has increased from -0.2% to 0.1% which we reckon that CHF to gain momentum, by 2016 Switzerland is expected to be the only G10 country with inflation still hugging zero.

While its real rates are amongst the highest in G10, we have shown before those nominal rates are more important in driving spot FX returns.

The SNB does not expect inflation to turn positive until early 2017 and it expects to keep rates at -0.75% throughout the forecast horizon.

This week's Zew Economic Expectations on Swiss business has been healthier, the diffusion index increased to 18.3 from previous flash 9.7 that indicates investors and analysts are highly informed by virtue of their job, and changes in their sentiment can be an early signal of future economic activity.

On the flip side, the expectation on an extension to ECB QE in Sept 2016 which should flatten the path for EUR/CHF next year.

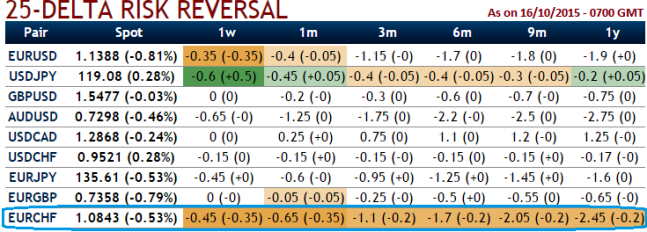

Delta risk reversals of EURCHF for next 6 months: The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon and as a result delta risk reversal for EURCHF was turning into negative.

From the nutshell, 25-delta risk of reversals of EUR/CHF the most expensive pair to be hedged for downside risks after AUDUSD as it indicates puts have been over priced.

As it showed the highest negative values indicate puts are more expensive than calls (downside protection is relatively more expensive).

FxWirePro: Inflation excites Swiss franc, delta risk reversal signals EUR/CHF’s bearish sentiments

Friday, October 16, 2015 9:10 AM UTC

Editor's Picks

- Market Data

Most Popular

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth