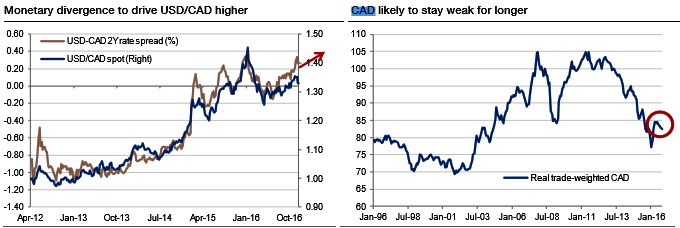

The Canadian dollar now appears cheap both from a PPP perspective and versus a time series of the real trade-weighted exchange rate (refer above graph). This has helped to support growth and is expected to last for longer, with the BoC likely to lean against any abrupt strengthening of the currency. However, we do expect further room for loonie gains against the APAC currencies, if as we expect, the Chinese slowdown deepens through 2017.

BoC firmly on hold: The lukewarm outlook suggests that the Bank of Canada will keep policy steady in the face of Fed tightening, which should nudge USDCAD gradually higher through mid-2017. The loonie remains highly correlated to oil prices, but it will likely not be able to resist broad US dollar strength (refer above graph).

Underperforming economy: The Canadian economy has bounced back in the second half of 2016 after the economic disruption caused by the Alberta wildfires earlier in the year. Economic growth, however, remains tepid overall. Business investment continues to be sluggish following the end of the energy sector boom, and export performance has not met previously upbeat expectations.

Newly announced mortgage tightening measures will also exert a negative impact on homebuilding activity. Overall inflation pressures remain limited, with the headline and core inflation rates under 2%. Low interest rates and recovering crude oil prices will likely help spur growth moderately in 2017.

Hence, add longs in a 1m2w 87.25 CADJPY AED digital put; alternatively, buy 4M sell 2M CADJPY OTM put at 80.0 strike in 1:0.761 notional.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed