The US dollar index (DXY) has appreciated 0.5% to 97.4 on the weaknesses of its major components, despite widespread expectations of an imminent rate cut. US data flow has been highlighting the USD’s relative advantage over the euro, which accounts for 57.6% of the weight in the DXY.

The slowdown in EM retail bond flows is not too surprising given weakening return momentum.

Elsewhere, the prospect for sustained private capital outflows from CHF suffered a setback due to the protracted cyclical slowdown in the Euro area and the fading prospect for the ECB to begin to normalize policy over any reasonable timeframe.

Furthermore, we run you through the unfolding of the EM FX hedges as policy easing balances slower growth. It looks like we are in for a period of relative calm where weak growth data remains balanced by supportive central banks, in an environment of low yields. The outcome of the G20 meetings of end-June was much in line with what markets anticipated and have arguably not changed opinions of the likelihood of a US-China deal. Growth indicators still point to the downside, but the Fed remains on course to ease in the upcoming months according to our US economists. While the market is already aggressively pricing the next year of cuts in the US, we believe the overall backdrop should remain supportive for the duration in local markets and without the need to FX hedge for now.

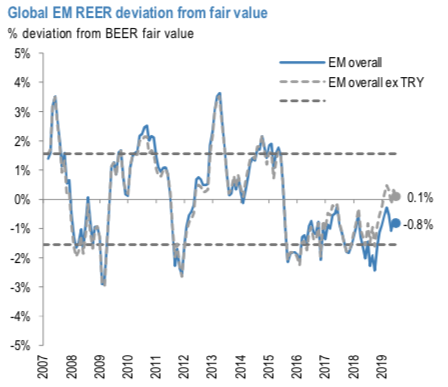

The valuations still appear neutral. Our BEER fair value models put currencies at fair value (refer above chart) and while EM FX positioning shows a small OW according to our client survey, this is not as stretched as positioning in EM sovereign credit and EM local rates which have much larger consensus OWs.

Our new EM FX risk appetite indicator shows bullish positions are starting to build, but are not stretched yet. Given our expectations of a more balanced near-term outlook for risk and still supportive duration backdrop, we have recently taken off our EM FX hedge moving FX from UW back to MW in our GBI-EM Model Portfolio. Courtesy: JPM

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand