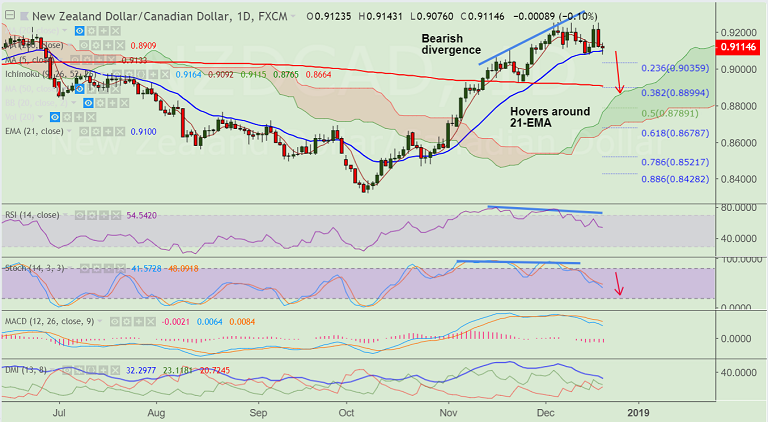

NZD/CAD chart on Trading View used for analysis

- NZD/CAD has retraced dip below 21-EMA support, bias remains bullish.

- The pair is trading lagely muted at 0.9116 at the time of writing. kiwi dented on dismal NZ Q3 GDP and risk-off market profile.

- Data released earlier today showed New Zealand Q3 GDP arrived at +0.3% q/q vs the 0.6% expected and 1.0% in Q2.

- For the y/y, GDP was up 2.6% missing forecasts at 2.8% compared to 3.2% prior, revised up from 2.8%.

- Technical indicators are biased lower for the day and bearish divergence on RSI and Stochs keeps scope for weakness.

- Break below 21-EMA to see dip till 23.6% Fib at 0.9035. Further weakness will see test of 200-DMA at 0.89.

Support levels - 0.91 (21-EMA), 0.9035 (23.6% Fib), 0.89 (200-DMA)

Resistance levels - 0.9133 (5-DMA), 0.92, 0.9270 (Upper BB)

Recommendation: Watch out for decisive break below 21-EMA to go short.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory

Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different