Chart - Courtesy Trading View

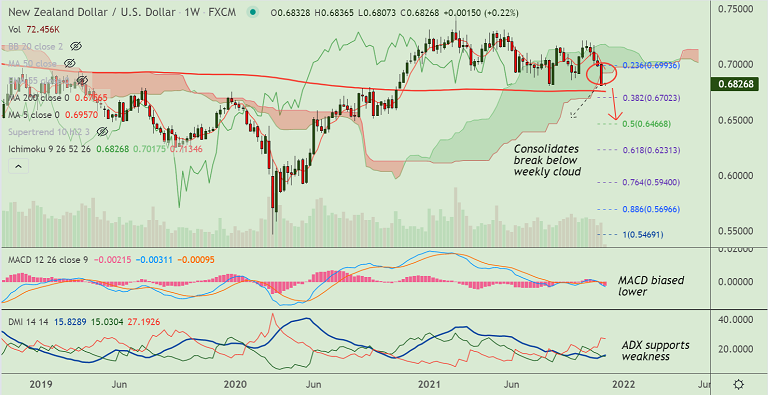

Technical Analysis: Bias Bearish

GMMA Indicator

- Major and minor trend are strongly bearish on daily and intraday charts

Ichimoku Analysis

- Price closed below weekly cloud in the previous week, opening downside

- The pair trades well below the daily cloud

Oscillators

- Momentum strongly bearish, Stochs are RSI are sharply lower

- Oversold conditions may cause some pullbacks

Bollinger Bands

- Bollinger bands are spread wide apart

- Volatility is high and rising

Major Support Levels: 0.6756 (200-week MA)

Major Resistance Levels: 0.6862 (5-DMA)

Summary: NZD/USD trades with a major bearish bias. Break below weekly cloud has opened downside. Scope for dip till 200-week MA.