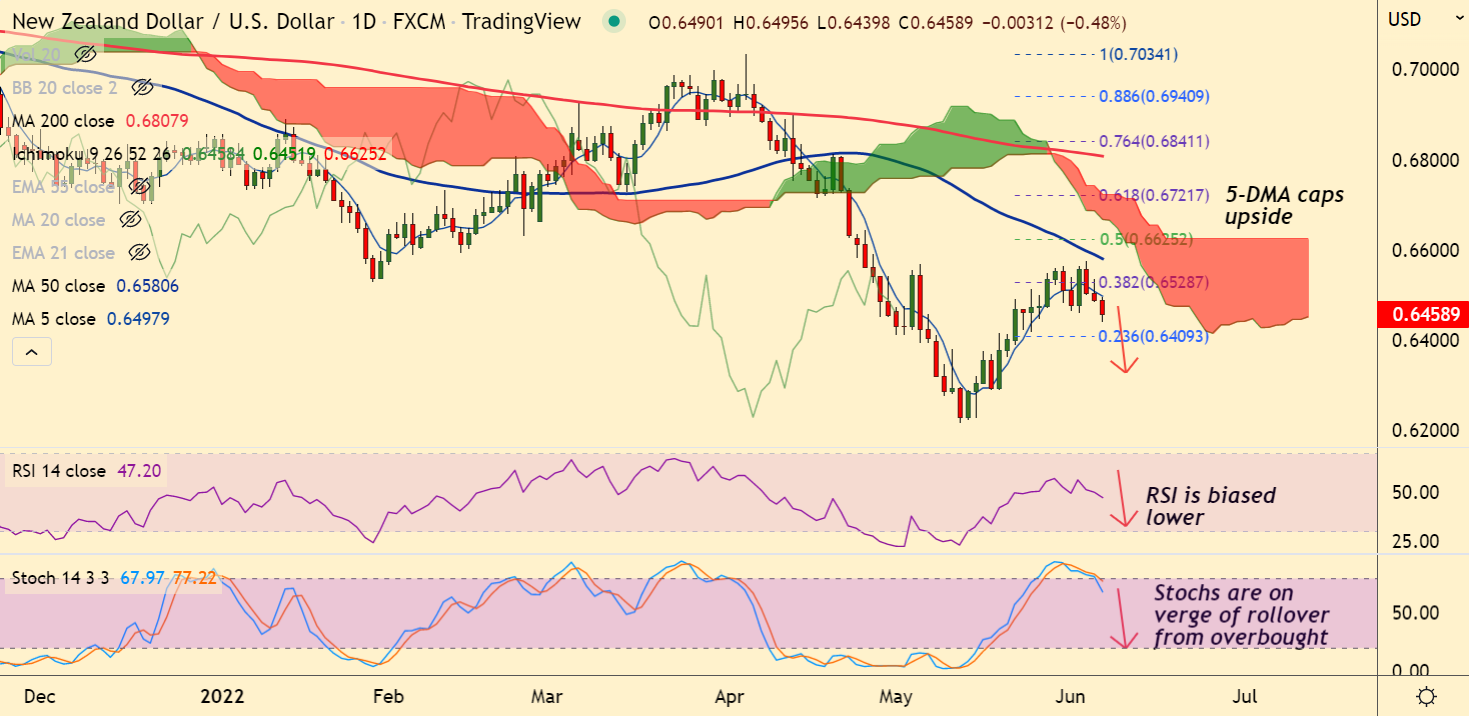

Chart - Courtesy Trading View

Technical Analysis:

- NZD/USD was trading 0.55% lower on the day at 0.6455 at around 10:40 GMT

- The pair is extending downside for the 3rd straight session, bias is still bearish

- Price action has slipped below 200H MA, upside remains capped at 5-DMA

- Momentum is turning bearish, RSI is biased lower, Stochs on verge of bearish rollover from overbought levels

- GMMA indicator shows major trend is bearish, while minor trend is turning bearish

Major Support Levels:

S1: 0.6425 (20-DMA)

S2: 0.6409 (23.6% Fib)

Major Resistance Levels:

R1: 0.6477 (21-EMA)

R2: 0.6497 (5-DMA)

Summary: NZD/USD trades with a bearish bias. Bears eyes 20-DMA support at 0.6425. Breach below will drag the pair lower below 0.64 handle.