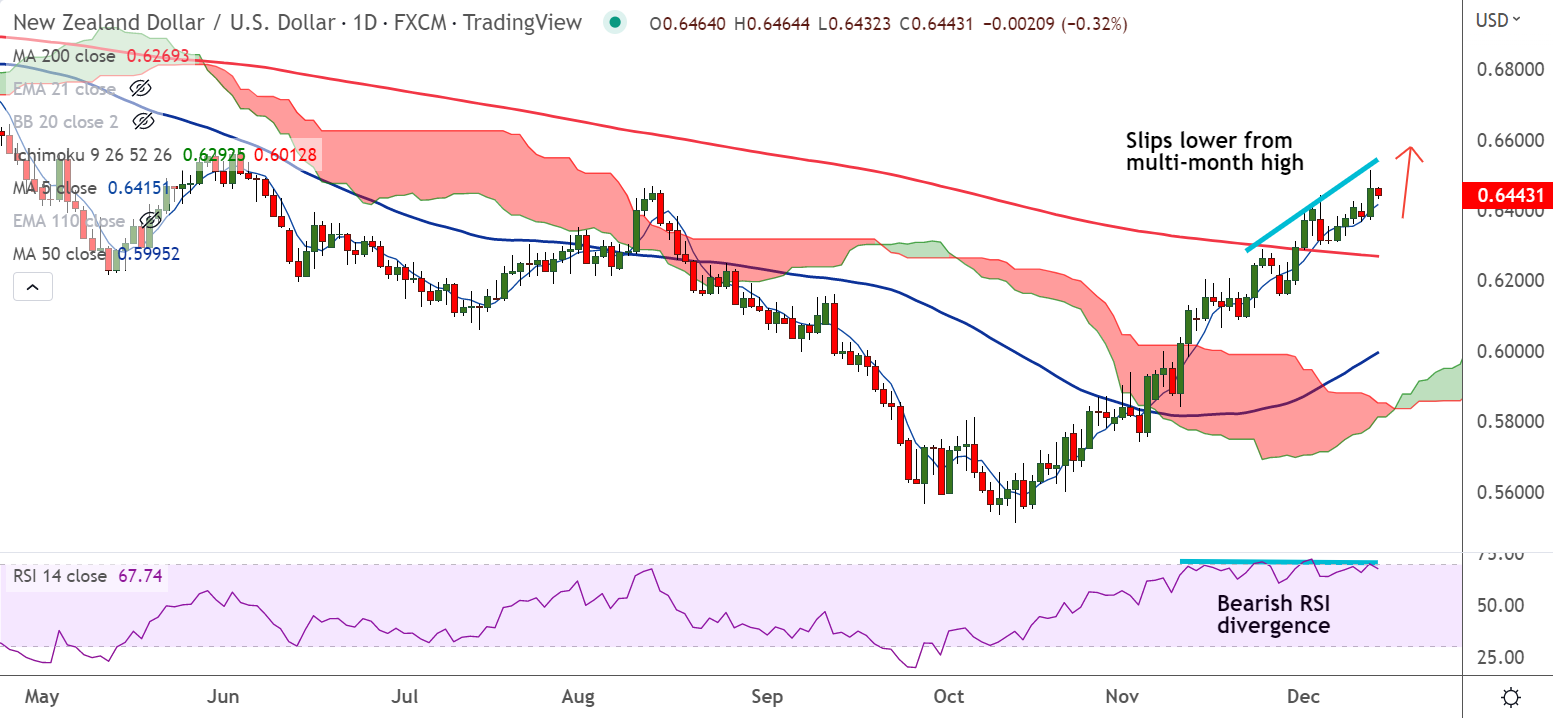

Chart - Courtesy Trading View

Spot Analysis:

NZD/USD was trading 0.28% lower on the day at 0.6445 at around 10:40 GMT.

Previous Week's High/ Low: 0.6442/ 0.6302

Previous Session's High/ Low: 0.6513/ 0.6373

Fundamental Overview:

Markets turn cautious ahead of the Federal Reserve meeting later on Wednesday.

The central bank is expected to raise interest rates by 50 basis points (bps). Traders will focus on the statement for clues on any potential changes to the Fed’s hawkish stance against inflation.

On the New Zealand front, investors await the release of the Gross Domestic Product (GDP) data, due Thursday.

Analysts expect the Q3 quarterly GDP data slip lower to 0.9% vs. the prior release of 1.7%. While the annual GDP is expected to expand sharply by 5.5% against the former release of 0.4%.

In the Half Year Economic and Fiscal Update, the New Zealand Treasury has forecasted three-quarters of a shrinking economy starting in the second quarter of 2023.

Technical Analysis:

- NZD/USD slips lower from fresh 6-month highs hit on Tuesday's trade

- Bearish RSI divergence adds to the downside bias

- GMMA indicator shows major and minor trend are bullish

- The pair is extending gains for the 9th consecutive week

Major Support and Resistance Levels:

Support - 0.6414 (5-DMA), Resistance - 0.6626 (200-week MA)

Summary: NZD/USD trades with a bullish bias. Bearish RSI divergence raises scope for some downside. Resumption of upside will see test of 200-week MA at 0.6626.