FxWirePro Currency Strength Index for NZD/USD: Bias Bullish

FxWirePro's Hourly USD Spot Index was at 131.953 (Bullish)

FxWirePro's Hourly USD Spot Index was at -101.709 (Bearish)

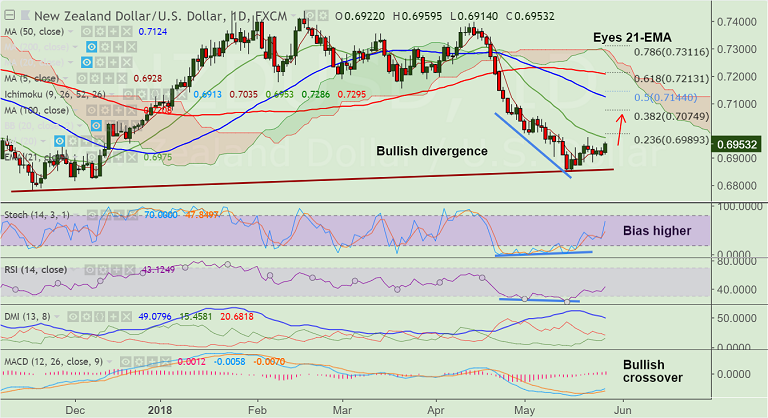

Technical Analysis: Bias Bullish

- Bullish divergence on RSI and Stochs

- RSI and Stochs have rolled over from oversold levels and biased higher

- MACD shows bullish crossover on signal line

- Price has just broken above 20-DMA

Support levels - 0.6928 (5-DMA), 0.69, 0.6850 (trendline)

Resistance levels - 0.6975 (21-EMA), 0.6989 (23.6% Fib), 0.70, 0.7083 (55-EMA)

Recommendation: Good to long on break above 21-EMA (0.6975), SL: 0.6925, TP: 0.70/ 0.7075/ 0.7120

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.