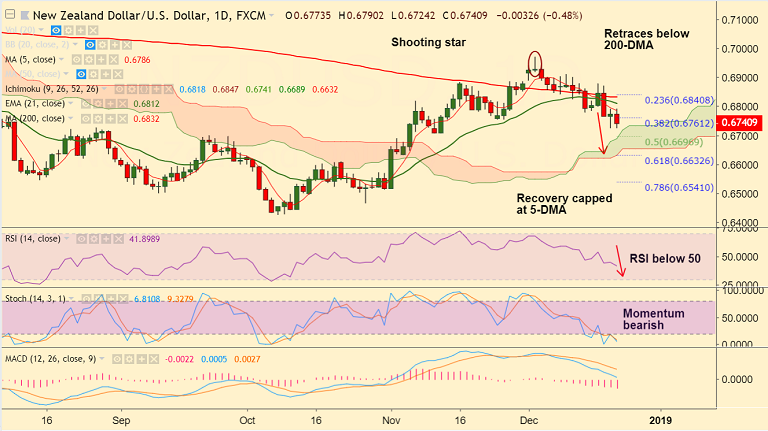

NZD/USD chart on Trading View used for analysis

- NZD/USD recovery capped at 5-DMA, bias remains bearish.

- The pair has slipped below 38.2% Fib and finds next major support at daily cloud top at 0.6689.

- Antipodeans under pressure amid risk-off market profile. Scope for further weakness.

- Also, technical indicators have shown a sharp switch in trajectory. RSI and Stochs are sharply lower. Volatility is rising and MACD supports weakness in the pair.

- Focus on U.S. GDP and PCE data for further impetus. Political turmoil and probability of Government shutdown weighs.

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-USD-slips-below-382Fib-kiwi-dented-on-dismal-NZ-Q3-GDP-and-risk-off-market-profile-1475732) is progressing well.

Recommendation: Hold for targets.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory

Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data