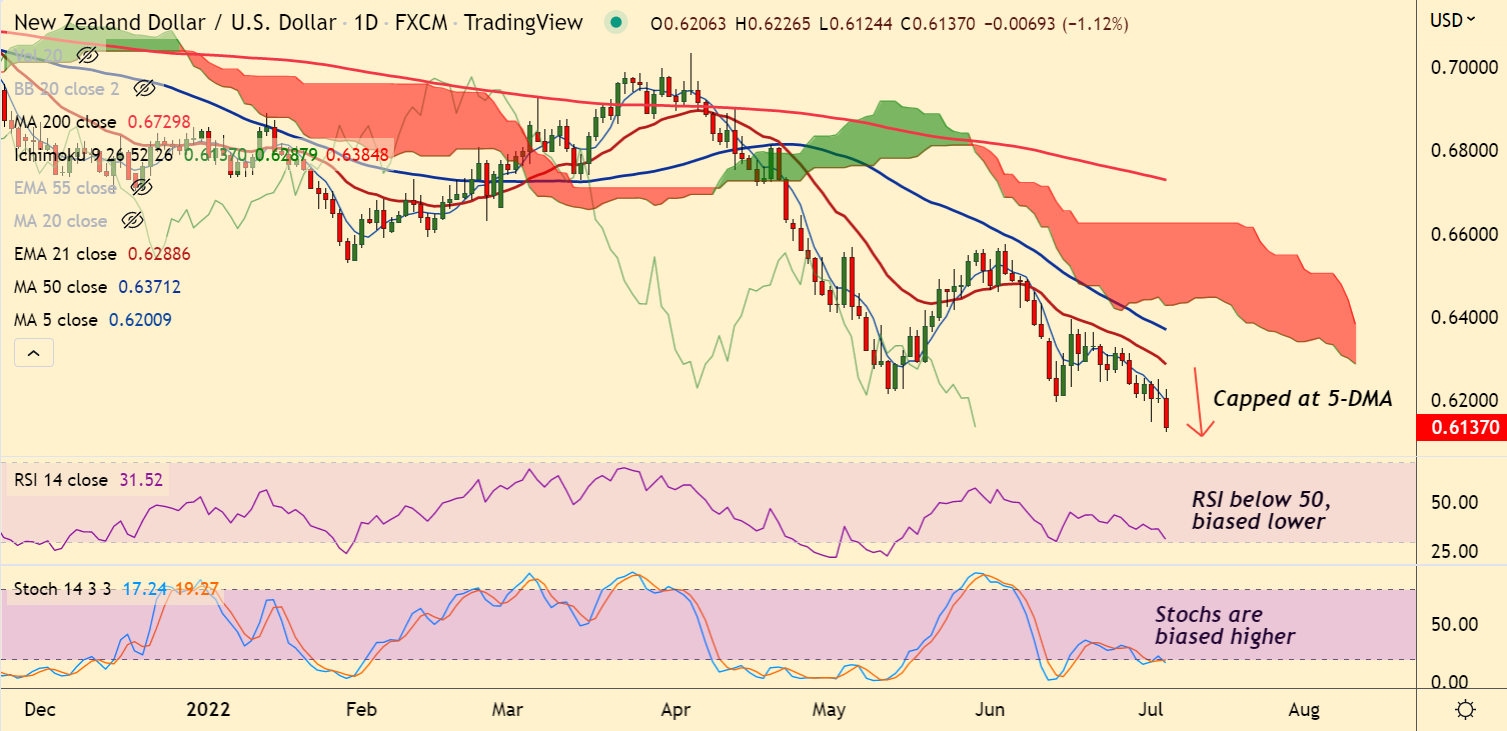

Chart - Courtesy Trading View

NZD/USD was trading 1.03% lower on the day at 0.6142 at around 14:30 GMT.

The pair trades at levels unseen since May 2020, scope for further downside.

Upside remains capped at 5-DMA. Major moving averages are trending lower.

Stochs and RSI are sharply lower, momentum is strongly bearish.

Price action is below daily cloud and Chikou span is biased lower.

FOMC Minutes on Wednesday and the release of June’s Nonfarm Payrolls on Friday will be crucial for further direction.

Support levels:

S1: 0.61

S2: 0.5920 (May 2020 low)

Resistance levels:

R1: 0.6201 (5-DMA)

R2: 0.6288 (21-EMA)

Summary: NZD/USD trades with a bearish bias. Scope for test of fresh multi-month lows.