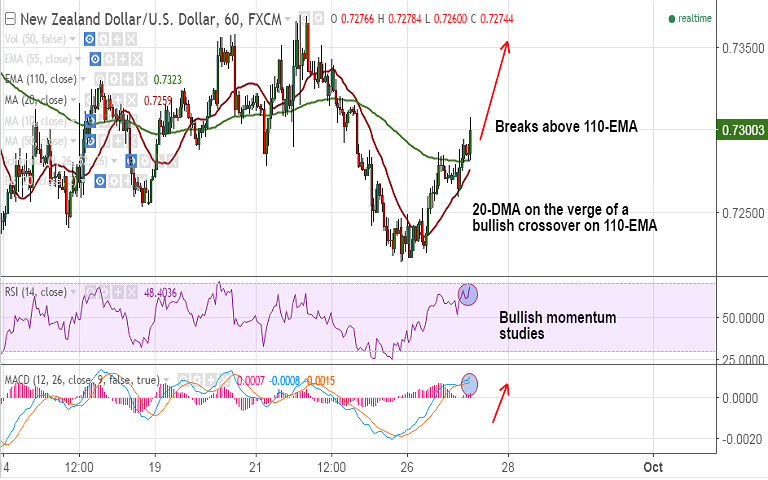

- NZD/USD breaks above 110-EMA on hourly charts, after taking 50-DMA support on Monday's trade.

- Renewed risk-on sentiment supporting the Kiwi as also upbeat Chinese industrial profits data.

- CB Consumer Confidence index from the US, later during NA trading session in focus for clues on further direction.

- Major support levels - 0.7231 (50-DMA), 0.7220 (Sept 26 low), 0.72, 0.7197 (cloud top)

- Major resistance levels - 0.7311 (20-DMA), 0.7369 (Sept 22 high), 0.7380 (Aug 26 high)

Recommendation: Good to long dips around 0.73, SL: 0.7270, TP: 0.7365/ 0.7380