Nikkei pared some of its after a minor pullback due to US economic uncertainty and yen strength. It hit a low of 36192 at the time of writing and is currently trading around 36830.

Markets eye US Non-Farm Payroll data today for further direction.

The yen gained strongly against all majors as recession fears have increased demand for safe-haven assets.

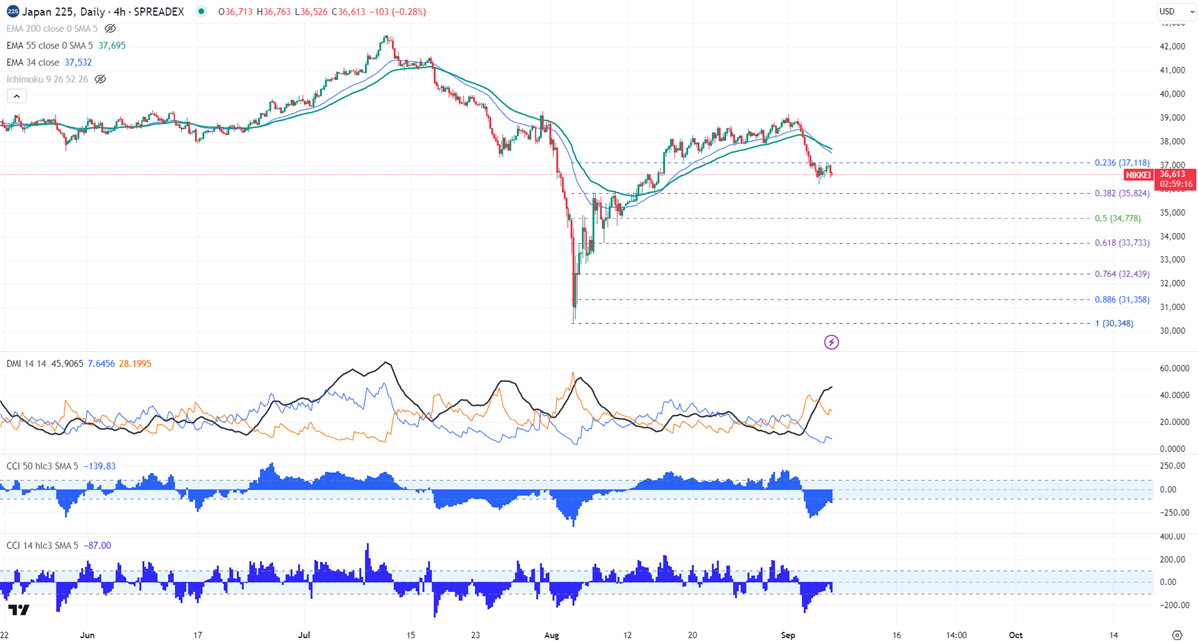

The index holds below short term (34 and 55 EMA) and long-term moving average (200- EMA) in 4-hour chart.

The near-term resistance is around 37100, any violation above will take the index to 37347 (23.6% fib)/ 37500/37695/38000. Overall bullish continuation only above 42550.

On the lower side, immediate support stands around 36410, any breach below will drag the index down to 36285/36000.

Indicator (4- hour chart)

CCI (14)- Bearish

CCI (50)- Bearish

Average directional movement Index - Bearish

It is good to sell on rallies around 37280-300 with SL around 37685 for TP of 36200.