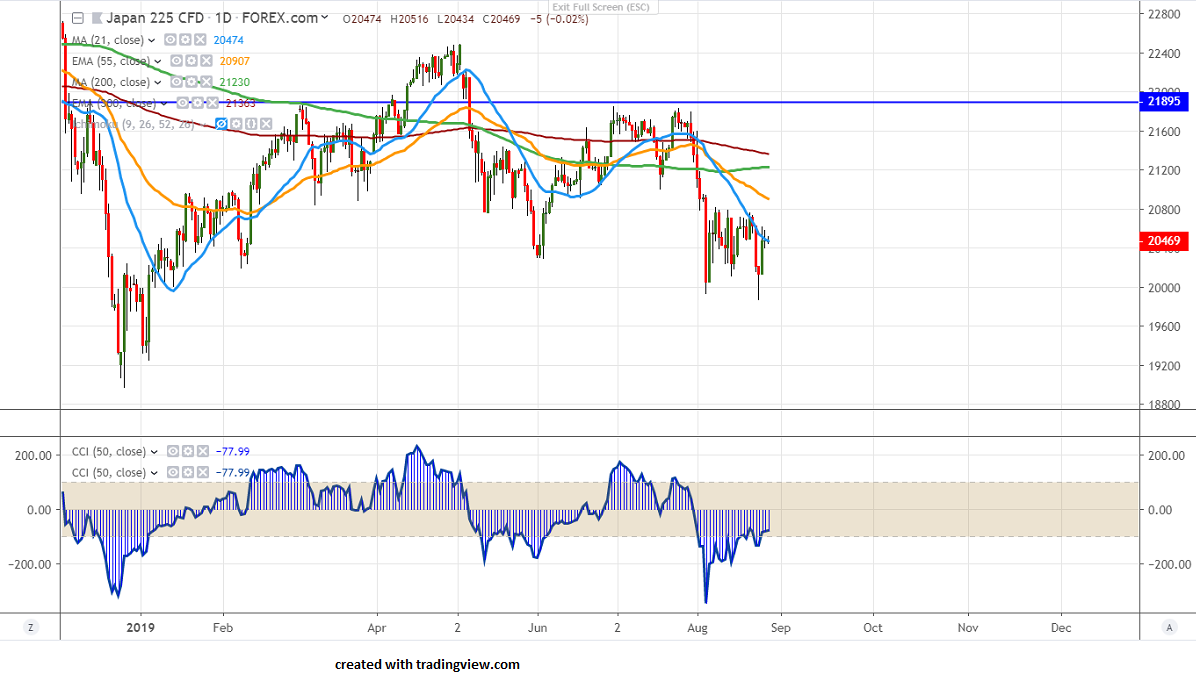

Major resistance- 20800

Major support - 19900

Nikkei is trading slightly higher following minor jump US futures. The overall trend is still weak due to uncertainty in the US-China trade talks. The US 10 year bond yield continues to trade lower and spread between US 10-year and 2-year has inverted by 5 bpbs for the first time since 2007. The index hits high of 20584 and is currently trading around 20474.

US Market- The Wall Street has closed lower with Dow Jones and S&P500 25777 (0.47%) and 2878 (0.32%).

Japanese Yen- USDJPY is trading in a narrow range and any break above 106.45 confirms intraday bullishness and a jump till 107-107.20 likely.

Shanghai composite- Shanghai is struggling to close above 300- day EMA and any further bullishness can be seen only if closes above 2911 level. Any convincing break above targets 2960/3000 is possible.

Technically Nikkei facing near term resistance around 20800 and any minor jump can be seen only if it closes above this level. Any close above targets 21220/21500.

On the flip side, near term support is around 19900 and any violation below this level will take the index till 19600/19200. The minor support is around 20400/20100.

It is good to sell on rallies around 20525-550 with SL around 20800 for the TP of 19900.