Nikkei 225 -

Nikkei lost its shine following the footsteps of Wall Street. It hit a low of 37118 at the time of writing and is currently trading around 37228.

US stocks plunged sharply led by IT stocks after weak US ISM manufacturing data increased fears of recession. US ISM manufacturing PMI rose to 47.20 in Aug from 46.80 the previous month, below the forecast of 47.50.

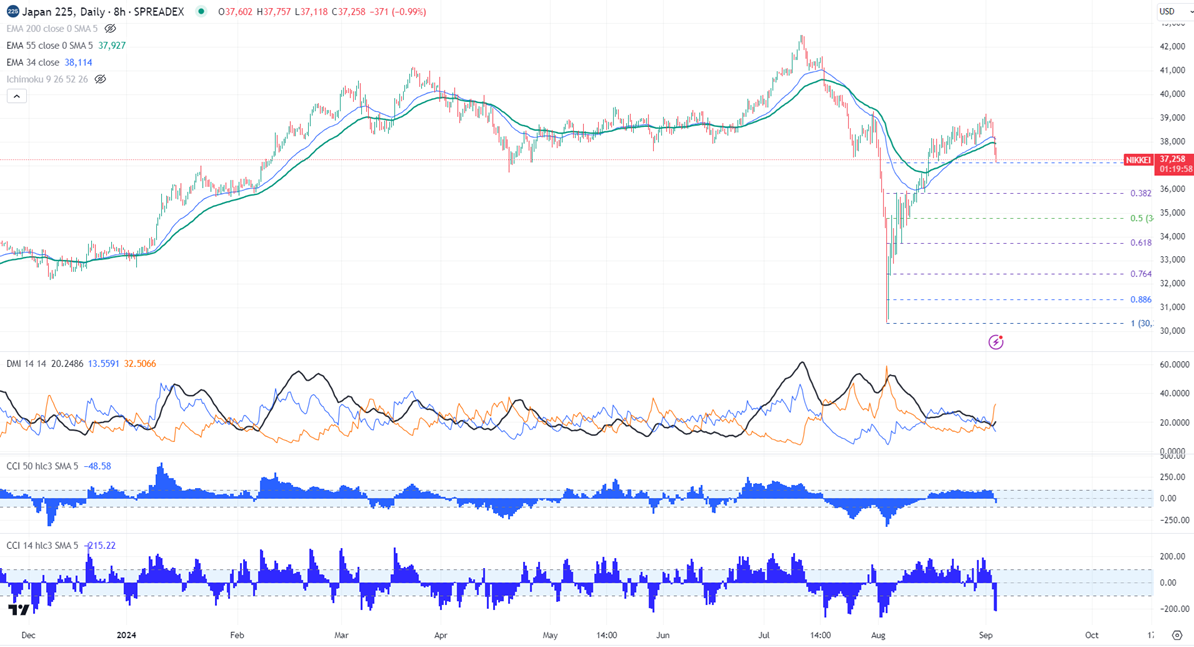

The index holds above short-term (34 and 55 EMA) and long-term moving average (200- EMA) in 8-hour chart.

The near-term resistance is around 37525, any violation above will take the index to 37780/38166. Overall bullish continuation only above 42550.

On the lower side, immediate support stands around 37000, any breach below will drag the index down to 36700/36320.

Indicator (4- hour chart)

CCI (14)- Bearish

CCI (50)- Bearish

Average directional movement Index - Bearish

It is good to buy on dips 37500-525 with SL around 37200 for a TP of 38500/39335.