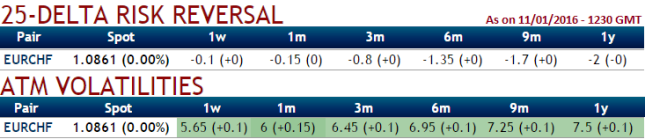

The risk reversals with longer expiries are attractive to position for lower EURCHF with e.g. 1Y 25D risk reversals (see negative 2, tepid vols below historic average) As an alternative to EUR, being short the CHF against the JPY is attractive a relative bet - safe havens, but one of them safer, considering that Asian risks will likely be the focus this year.

In addition, valuations are at historic extremes (CHF too strong).

Vols and risk reversal: Based on order flow analysis, the low implied volatility is also experienced from last couple of days and would likely to perceive the lower side for next 2-3 months or so as shown in the nutshell.

While delta risk reversal indicates bearish hedging activities have been piling up and it would remain the same for 3-6 months or so. As a result ATM puts are priced in costlier.

Thus, short 2% OTM call and short one more -1.5% OTM put of the same maturity for net credit. The OTM strikes should be selected so as to meet out the above specified bands on both the sides. Select the strikes to match the above mentioned price bands.

The rationale is that the range bounded market is evidenced and the continuation is signaled by risk reversals, technicals and lower implied volatility at 5-7% in next 6 months to substantiate this reasoning, we recommend taking the advantage of these benefits through above option trading strategy.

This strategy derives limited returns with unlimited risk that is taken when the options trader thinks that the EURCHF would experience little volatility in the near term.

FxWirePro: Risk reversal signals how to position EUR/CHF in range bound trend

Tuesday, January 12, 2016 9:08 AM UTC

Editor's Picks

- Market Data

Most Popular