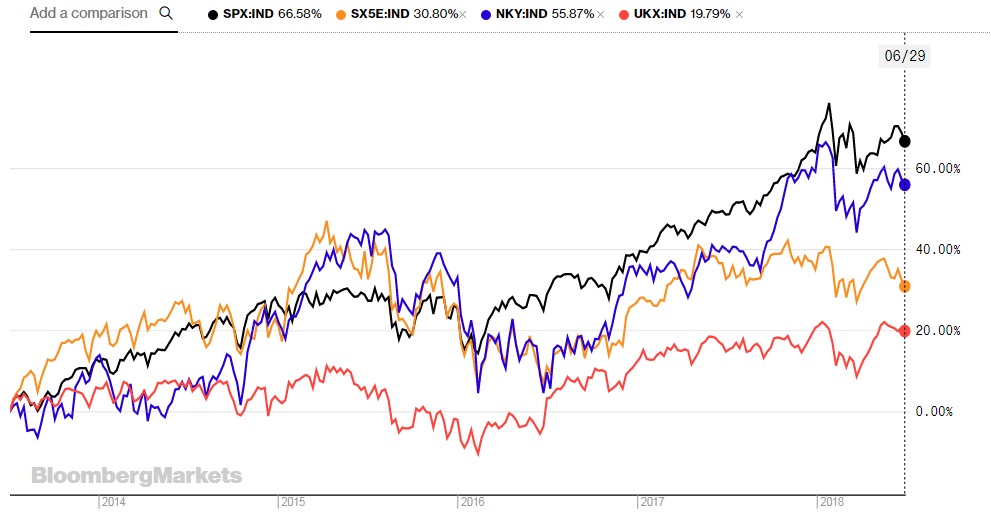

Since 2016, the U.S. stock markets have been outperforming its global peers and we believe that they would continue to do so going ahead.

All the latest statistics; unemployment report, PMI numbers, GDP growth are pointing to the strength of the U.S. economy, which is greatly benefiting from the tax cuts, where corporate taxes were sharply reduced to 21 percent. In addition to that, President Trump has announced that the next phase of tax cuts would be arriving soon, where there would benefit for the American Middle Class and corporate tax rates would be lowered further.

At the same time, PMI numbers, GDP statistics point to a slowdown in other economies in Europe and in Asia. For example, while U.S. GDP is expected to be above 4.5 percent in the second quarter, the GDP in the United Kingdom has slowed to just 1.2 percent in the first quarter, the weakest reading since the financial crisis.

The chart shows that the U.S. benchmark stock index has outperformed European blue-chip index Eurostoxx50 by as much as 36 percent, and by 46 percent in case of FTSE100, the UK benchmark, and by more than 10 percent in the case of Japanese benchmark Nikkei225.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed