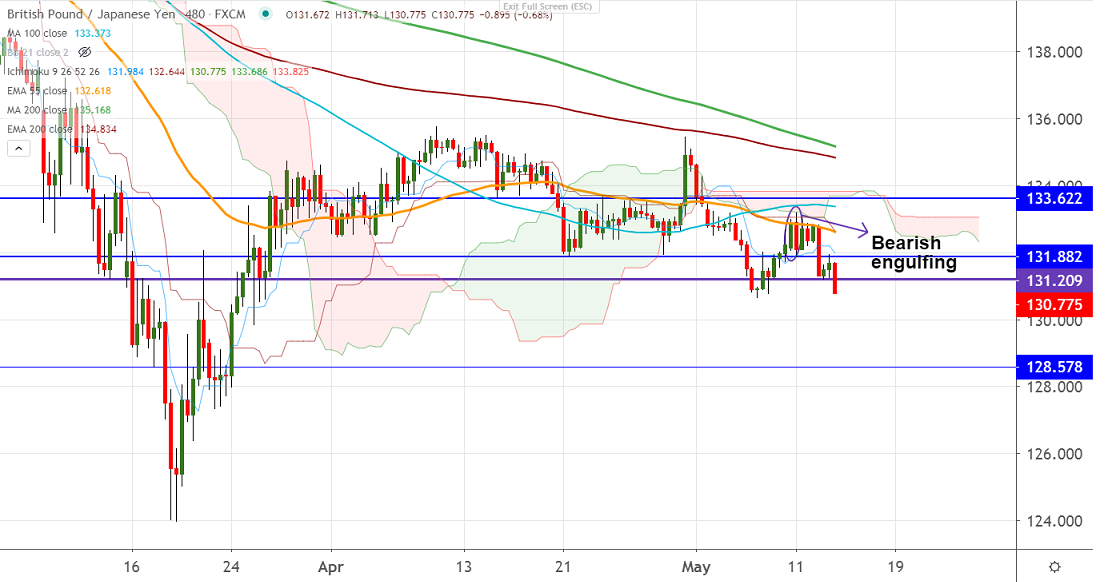

Chart pattern- Bearish engulfing pattern

Ichimoku analysis (8-hour chart)

Tenken-Sen- 132.19

Kijun-Sen- 132.86

GBPJPY has declined sharply after hitting an intraday high of 131.93. It has formed a double top around 133.20 and the short term trend is bearish as long as it holds. It hits an intraday low of 130.78 and is currently trading around 130.78.

USDJPY is trading weak and convincing break below 106.75 confirms bearish continuation.

The near term resistance is around 132.60 and any violation above will take the pair to 133.20. Minor trend reversal only if it breaks 133.20. The decline from 144 will get completed at 124.02 only if it breaks the 136 level.

On the flip side, 130.66 (May 6th low) will be acting as significant support and indicative violation below targets 129.80/128.

It is good to sell on rallies around 131.20-25 with SL around 132 for the TP of 128.