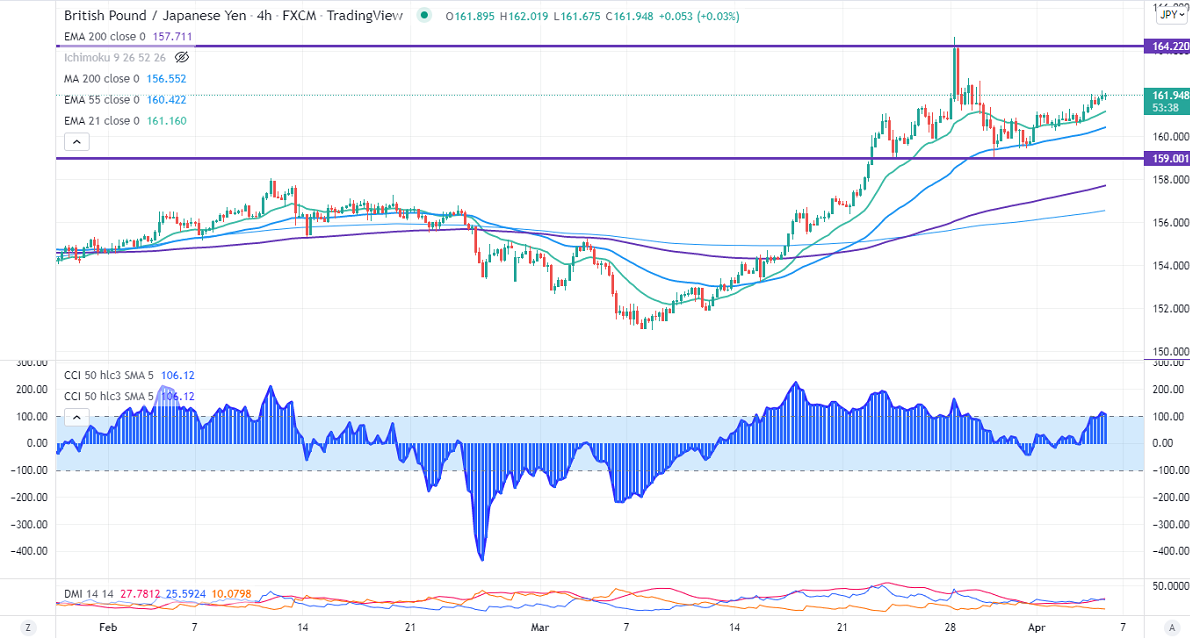

GBPJPY gained more than 100 pips yesterday on a weak yen. The policy divergence between Fed and BOE is putting pressure on the pound sterling at higher levels. Markets eye Fed meeting minutes for further direction. Any breach below 1.3050 will drag GBPUSD further down. GBPJPY hits an intraday high of 162.13 and is currently trading around 161.95.

USDJPY

USDJPY is trading higher for a fourth consecutive day on the surging US treasury yield. Any bullish continuation only if it breaks 125.20.

Technicals:

On the lower side, immediate support is around 161.50, breach below will drag the pair to the next level to 160.50/159.70/159. The minor resistance to be watched is around 162.20, a break above that level confirms intraday bullishness, and a jump to 164 is possible.

It is good to buy on dips around 161 with SL around 160 for the TP of 164.